Trading Journal 20160203

Trading Journal 20160203

1. Trading Journal

2. Tip of the day

Trading Journal

As explained in a previous post, Shorts entered after a squeeze offer better visibility and have higher probability of success. So, the alert pad came back quite full. Most of the signals are frequent flyers on the short side.

Shorts are like a glasses of wine, they tend to be depleted, so they require regular top-ups. Let:s not complicate things here.

Here is how to read the above table

- Stop Loss: it has a dual function, one obviously to put a quick end to a bad trade for now. The second function of a stop loss is to calculate a position size. Those are isometric staircase stop loss using a multiple of ATR 2.5 or 2.6

- Limit: Entry is a choice, exit is a necessity. This has been severely back-tested and reinforced in real life trading: this strategy works best over time if we do not chase stocks. Stop Loss and Limit are used to calculate position size

- ATR: Average True Range 20 days, simple average.

- Weight: suggested position size. This is a Fixed Fractional Position Sizing method or equity at risk that assumes -0.10% risk per trade. This is a clean simple multiplier

- Risk Adjustment: this is the -0.10% factor

- Equity at risk: position sizies are rounded to the nearest lot and this gives residual equity at risk

- Ranking order: the bigger the better. For a same risk budget, the trade suggesting the largest size comes first. There is no “qualitative/fundamental” assessment here. Size is a primarily a reflection of the volatility signature

For the record, I have placed orders on some of those ETFs. I am not suggesting You should buy/sell/short sell or buy to cover any of those signals.

As You can see, the numbers at the right side of the charts are the same as the ones on the table. In fact, I go through every chart and write those numbers.

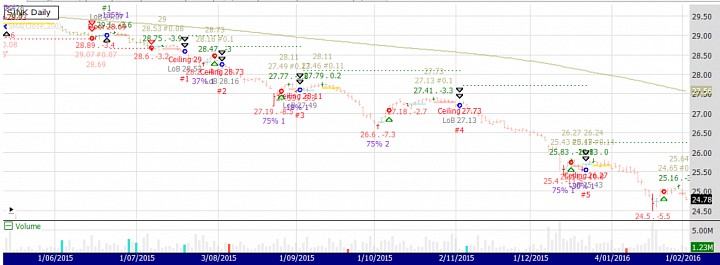

SJNK is another junk bond ETF. It has low volatility and clean trend. Those are rare and nice shorts: bearish calm

On the Long side, the information is below the swing point. Interestingly enough, the algorithm flagged a partial exit shortly before this re-entry. Re-entries are possible only after a partial exit has been performed.You

The logic is simple: take risk off the table before adding some. Adding to a position with open risk compounds risk. It works until it does not

Tip of the day

Whatever asset class and time frame, we all trade the same thing: risk. So, the first order of business after entry is to reduce risk.

enjoyed this essay on short selling – thankyou.

i always wondered why i preferred shorts . . . and now i know

i’m one of the crazy ones@!

Hello Justin,

Comments like yours are the fuel that keep me going. Thank You

As as short seller, what is your biggest challenge right now ?

Cheers,

Laurent

Hi Laurent,

I thoroughly enjoy all of your Quora answers as well your blog posts. However, I was wondering if you could elaborate more on your trading process? Based on the charts you provided, i’m assuming that you keep a “core position” and then scale out partially, and then add back to full size on the next lower high(higher low)? Lastly, Im assuming that this fluid process not only keeps your sane, but also smooths out the overall portfolio volatility?

Hello Darrin,

Thank You very much for your much appreciated feedback.

I was cursed/fortunate enough to be a short-seller by mandate. This means 100% short every day for 8 years in a tough environment. Rule N.1 of investing: survival, not profit. Trade to survive first and then You can think about making money. The scale-out model came out of the frustration of watching hard earned profits evaporate and close at the wrongest time. One day, I realised I could cover a portion of the position as soon as a rally happens. This would lock in some profits and make the rebound more tolerable. I practiced this until i realised I could short again thereafter. A good short is like a glass of good wine. If it is so good, why stop at one shot ?

Then, the idea emerged. It was backed up by solid maths. I guess You have seen the P&L distribution.

Now, on to the quantity. I use an algebraic formula to determine how much should stay in the portfolio given cost and isometric stop loss above cost. Whilst this is mathematically correct, I do not advocate this method. Numbers vary between 10% to 80% remaining balance. More importantly, even after years of practice, a large remainder rattles me. Make it simple: cut 2/3 of the position. This way, You are almost guaranteed to walk away with a profit. You might participate less, but You will abide by Rule 1: survival.

As far as volatility is concerned, You are right. It keeps semi-volatility low. I have come up with a new concept lately. I think it is extremely powerful: net exposure at risk. The concept goes like this: since trading is done in tranches, older tranches have positive carry (positive open risk). So, classic net exposure is no longer representative of risk. Older tranches should therefore be excluded from the calculation of net exposure. This means net exposure at risk could be around +/- 10%, with classic net exposure being at +/-50-60%. Those older trades can take care of themselves, provided stop losses are regularly refreshed of course. What matter are those newer ones. This sheds an entirely different light on a portfolio. The industry has been led to believe that market neutral is lower risk. Wrong, wrong and wrong. It is lower 1st dimension, i-we net exposure, apparent risk. Ask Goldman if their flagship market neutral was lower risk…

Now this acception of net exposure at risk allows for higher leverage. You see, if net exposure is constantly constrained around neutral, gross can be raised but it also geometrically inflates hidden risk of market dislocation. This net at risk means as long as net at risk is kept under control, net can freely oscillate, which means bigger free risk leverage. For reference, check the performance chart on the latest post. There are a vermilion and a black line. Black line stands for net exposure, somewhere around -60% and a net exposure somewhere around -5-10%. This means that all older shorts have risk-free carry.

Cheers,

Laurent

Hi Lauren,

Great series of posts.

I have a couple of questions on the basic risk calculations:

1. The spreadsheet examples shown on this post (2/2/16) suggest that the stop loss seems about Entry + 5.5 X ATR, i.e. n = 5.5. I thought you mentioned in other posts that n is around 2.5.

2. By “Isometric Stop loss”, does it mean your target is also about the same distance from the entry and stop?

Stop Loss = swing +/- 2.8 ATR[20]

The 2.8 value comes from a density probability of retracement magnitude

Excellent question: You know your stuff. The answer is Yes, but not for the reasons You think.

Isometric stop loss means stop loss is the same across all open positions

Now, the distance to target price was originally equidistant to the stop loss. This means closing 50% of the position would result in net residual risk zero. Once half the trade is closed, then residual risk is null, which really builds up mental capital

Example:

Entry Cost: 10. Stop Loss: 8, Px Last: 12, Shares: 2000

Risk = (8-10) * 2000 = -4,000.

Partial exit 1,000 shares

Profit = (12 -10) * 1000 =2,000

Open Risk = (8-10) * 1000 = -2,000

Residual risk = P&L + Open Risk = 0

Another version of this equation is to move the target closer but exit a larger portion. For example, if target is 10% of the distance to stop loss, You would then have to exit 90%of the position to have zero residual risk. This method has the advantage of capturing discrete narrow moves. It leaves very little risk on the table. The problem is that it mobilizes a lot of buying power, hopefully for shorter periods

Did I answer your question

Yes, Laurent. Thanks for the examples.

Hi Laurent, I first heard you on Better Systems Trader. At first I thought you were chinese or japanese (please forgive me). It must have been the reference to the Japan market you were trading in. I fell in love with your humor, and I paid close attention to what you said. I too love shorting, but mostly because I am a rebel. Lately (this week) this can get me emotionally upset, because I wait until the short squeeze is done and the short looks good, but meanwhile I missed the opportunity to ride the SPY up super high March 1st. Ugh! The next hurdle is the fear and uncertainty when you read and heard a majority saying we are going to $215 ! I know it’s a good sign for a short seller to hear everyone thinks we are going to the moon, but at times it can be confidence wrecking. It takes a lot of discipline (mental control) to survive in this game. I lookforward to recv your email updates.

Ball,

You have the funniest e-mail address i have seen in a long time. I hear You on SPY. This is the kind of squeeze that would make Barry White’s deep rich baritone sound like Barry Gibbs high fluty falsetto, don’t You think Mr Balls out stock (wow, what an address!). That has been a rough ride. I also feel like revenge trading. Actually, I did and I am losing not only on SPY but VOX. This is bad. The market does not care about me, about You, about anyone. Ms Market does not take it personally, she does not pick small change.

There is actually something better than revenge trading. It is called re-parenting in the Jungian archetype. It soothing ourselves for the hurt, instead of cultivating anger and resentment. Basically, it is like a parent would soothe a child, when he hurts himself. This activates memory center and regulates the amygdala. I am not a cat lady, I am a short-seller. So, self-forgiveness and self-compassion is not a feel good thing, it is survival when You are parachuted deep into enemy territory with a lovely Swiss-army knife and a compass.

Second thing: box concept. Always have a stop loss, a partial exit (50% or x% of positions exit) and then time exit rules before entering a short This way, any position will trip an exit signal. If You wait for the market to give Yo an exit plan, don’t complain when it is a lousy one. The point, is when things go sour, the brain starts its internal chatter and it is not good. So, draw your own map first, because You will not like Ms Market’s

Thank You very much for your message, Very much appreciated

Laurent.

Great discussion and very refreshing to find someone in the financial markets which so much enthusiasm and energy to help others in their long and bumpy road.

I can relate to your post having shorted the 2008 GFC in November – December. this is the time i stared to trade on a full time basis and found it great but not economical, at least at the beginning. as i arrive at the party before complimentary entrees and refreshments were served. In two weeks i lost 20% of my account because i was following trading education that i did not relate to and of course the “environment did not cooperate” as you discussed in better systems trader , even thought the signs were there.

Great experienced and invaluable lesson in human behavior, the index was down 20% and value investors were buying regardless, as they refuse to see the reality of the markets and choose to do the American patriot thing and support the markets at all costs 😉 … This . of course made it almost impossible for me to ride the down trade without experiencing huge draw-downs in holding an extended short position.

As someone once said ” you cannot re-write the past but you can start to change your ending”

Au Revoir!

Thank You very much for your message Jose,

Encouragements like yours are what keep me going.

Knowing how to short is simply the best way to protect your capital in volatile times.

What are You trading ?

I am writing a book about short selling now. What are your sticking points ? what would YOu like to know ?

Once agian, thank You very much for your comment

Thanks, this site is extremely valuable.|

This really is a topic which is in close proximity to my heart…

Best wishes! Where are the contact information though?

Hello

laurent.bernut@gmail.com

I like what you guys are up too. Such intelligent work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my web site :).