Diets don’t work. There has never been as many methods in the history of mankind. Meanwhile,

we are all getting fatter year after year. Diets just solve the wrong problem. The issue is not the food we ingest; it is how we relate to it. If instead of juicy, delicious, melting, tender, we associated beefsteaks with increased risks of coronary and cardiovascular accidents, reduced life expectancy, arteriosclerosis, high cancer risk, we might be less inclined to partake in the consumption of the flesh of the holy cow.

Stop losses are like diet. Every knows the recipe: “cut your losers, ride your winners”. Everyone also knows the way to accomplish this as well: stop loss losers. So, why do we all fail ? This is not a statistical problem about calculating optimum stop loss. The issue is the associations we make about closing positions. Stop Loss is an identity issue.

The topic of “stop Loss” deserves a book. This article merely scratches the surface. Yet, You will find powerful tools to reframe your stories and practical tools to set and honour stop losses

The interesting twist on stop loss is even though we intellectually know that we are wrong at least 50% of the time, our ego has us still behave as if we have to be right 100%.

Part 1: Making money on the markets goes against nature

“Hope is a mistake”, Mad Max, Aussie Philosopher

When people say I don’t believe in stop loss,…

… What they actually mean is I don’t like to admit I am wrong. They are often acutely aware that there is something wrong. Yet, they are willing to take on more pain and more uncertainty hoping that things will turn around and that they will be vindicated. This phenomenon has been studied by Nobel laureates Daniel Kahneman and Amos Tversky and known as risk seeking with losses and risk aversion with profits.

At the heart of this lies a confusion between outcome, i-e making/losing money, and process, i-e investment discipline. If being profitable equals being right, then logically losing money means being wrong. Any loss is therefore a direct attack on the self-image constructed by the ego. Since the ego wants to be right, and will always protect itself at any cost, we will sacrifice profits, endure excruciating pain for long stretches of time, jeopardise our jobs, our reputation even our families. The objective is no longer to be profitable but to validate the ego.

In Jungian archetype, the ego is an unhealthy version of the orphan. It is an early version of our personality, developed during the formative years of childhood. The image of the orphan, abandoned and mistreated, is actually a good metaphor.

Deep inside, the orphan’s intentions are good, he means well. He yearns for love and validation. Yet, as a child, he does not know how to handle situations gone out of control. His natural defense mechanism is denial and deflection. He will delay admission that something is wrong only to preserve ego driven self-image. He will pretend it did not happen. He will rationalise. Since he does not have better problem resolution method, he will show extraordinary resilience and wait until wrong turns back to right, until losses turn back into profits.

Do not underestimate the toxicity of a stubborn ego. Reputations and jobs have gone before egos surrender. Examples of pointless wars, companies run into the ground by narcissistic top management.

Bottom line: we are naturally inclined to let our losers run.

Why we cut our winners

We are not born eager to take profits early, quite the contrary in fact. “Beginners luck” stands for taking big risks on a low probability events, something no seasoned player would never dare. We become risk adverse after a few painful losses. We see profits evaporate before our eyes and want to keep some of it next time. If we never experienced losses, we would not feel the need to be risk adverse with profits. We would gladly embrace the riskiest strategies if it was not for the painful lessons we have learned through losses.

Bottom line: it is in our nature to run losers and then cut winners. Making money in the markets goes therefore against our nature

Part 2 How to re-write the story of stop loss

1. Accountability: take responsibility

The job of the ego is to protect itself at all cost, at all times. By now, You have probably concluded that this toxic form of ego has happened to people You know, but that You are immune to it. This makes for (hopefully) a nice read, but there is no need to change. Well, if that thought just crossed your mind, Your ego is playing tricks on You. Self-deception covers is a built-in feature that covers its own tracks. Try those exercise and see for yourself how good You are at deceiving yourself.

Exercise 1: Business is a form of procrastination

What do You do when there are uncomfortably large losses festering in your portfolio ? Do You read every analyst report ? Do You call companies, experts, read every article ? Or do You simply clean your desk ?

Chen & al asked students preparing for exams to grade their assiduity as well as break down their daily activities. Students who put off studying were also found more diligent at cleaning their desk , calling their parents. They were engaging in useful activities as a way to rationalise the guilt of not performing essential duties.

Exercise 2: The naked truth of numbers

In one of my previous jobs, i was fortunate enough to analyse the performance of managers stock by stock. If the three worst performing stocks had been removed from every portfolio, all managers would have outperformed their benchmark (before cost) every single year for the entire sampled period.

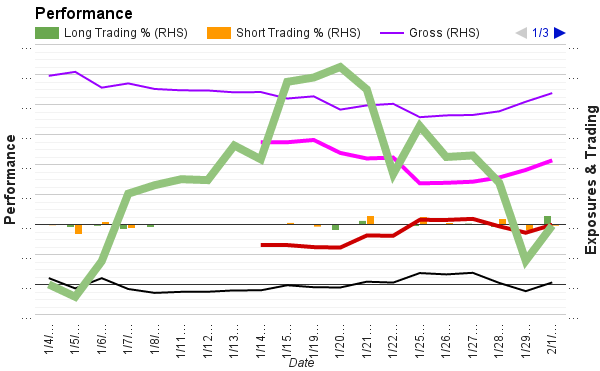

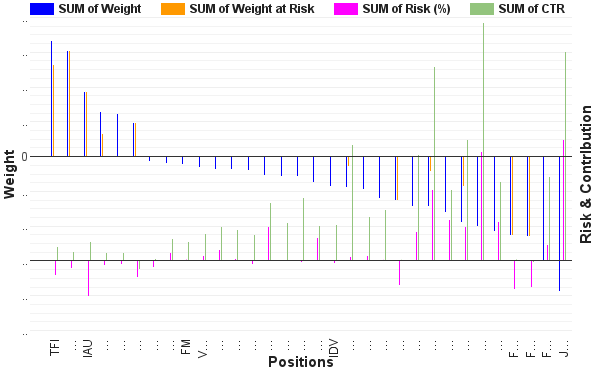

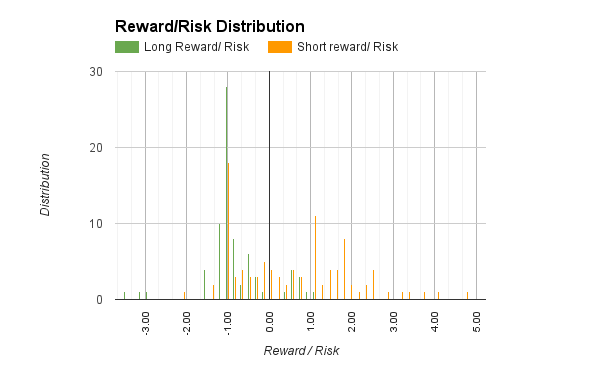

So, analyse all your trades and compare the bottom 5th percentile to the top 95th percentile. Download the trading edge vizualiser and run the numbers.

Calculate a 5th percentile tail ratio.

Your ego might have tricked You into believing You are rational. It might even have tricked You into believing You were doing the right due diligence, but in the end numbers don’t lie.

2. Reframing stop losses

If someone handed You the keys to the sexiest car on the planet, but whispered “brakes don’t work”, would You still take it for a spin ? Stop losses are like brakes. You may not like them, but they will keep You alive.

That simple metaphor is called reframing. It translates an abstract concept like stop loss into something we can relate to. Even though the absolute, imperative, non-negotiable necessity of a stop loss imposes itself beyond any beginning of dispute, we are still unlikely to execute, simply because enforcing them still conflicts our sense of identity. Bottom line, Stop loss is an identity issue.

3. Identity association

For example, diets are healthy, we know that. Yet, the overwhelming majority of people who have successfully lost weight end up putting it back on within a year. They have gone through the physical part, but they maintain unhealthy identity associations with food. Food is not the problem, how we associate to it is.

As long as we associate profitability with self worth on a trade-by-trade basis, the ego will trick us into skipping stop losses. We need to consciously associate being right with adherence to an investment process. This shifts focus from outcome (profitability) to process: being right is executing the plan.

This accomplishes two things:

- It becomes quantifiable and measurable: one trade is random. 100 trades are a data sample.

- It removes the incentive to cheat: being right is no longer an individual trade decision. You can lose money and be right. In fact, this association is stronger than the outcome orientation. It involves the neo-cortex in relationship to the dorso-lateral cortex (siege of identity). It literally rewrite the neural pathways to your identity

4. Clarity: Stop loss is a price, not a fundamental story, not a valuation exercise

Fairness is a trait common to all infants around the world. It manifests itself even before toddlers can speak. The orphan likes boundaries. He likes fairness. He does not like ambiguity. He hates favoritism.

Some people make the mistake of associating stop loss with change in fundamental story or valuation.

- Stories: prior to becoming a superstar with Emotional Intelligence, Daniel Goleman wrote an even more interesting book about the lies we tell ourselves. He argued that self deception is a built-in feature that covers its own tracks. We rationalise our bad choices. We will change our beliefs in order to match our actions. If You find excuses to avoid the gym, then You will fabricate excuses to allow losers in your portfolio.

- Valuations: Earnings estimates are notoriously inaccurate and jumpy. Forecast accuracy for analysts earnings estimates 1 year out within +/-10% range peaks at 25%, half a coin toss !

If a trade goes sour, You do not lose an investment thesis. You do not lose a P/E, DCF or some Frankenstein sum of the parts valuation either. You do not lose things that were outside your control in the first place.

You objectively lose two things: money and time. Risk is a number: this is how much You can afford to lose

5. When to set a stop loss

The best time to set a stop loss is … 5 minutes before entering a position. Stop losses must imperatively be set before entry

- Stop losses are necessary to calculate position sizes. If You do not set a limit on how much You can afford to lose, You may fail to appreciate what the market has in store for You

- Emotional interference: Once we enter a position, emotions kick in. Think of it as a prenuptial agreement. Commit to a price in writing, write it close to entry cost and price. Do not trust your brain with some abstract stop loss price. Your brain will renegotiate and it will trick You into a suboptimal decision (marketing buzzword for stupid mistake).

Stop Losses are necessary. We need to know when something is wrong, cut it out and move on for three reasons

6. Pre-mortem: enter each as if You expect them to fail

Everyone knows about post-mortem: this is the quarterly ritual when someone in management goes through your trading decisions with the benefit of hindsight…

Pre-Mortem is a technique invented by Gary Klein: fast forward in time and visualise the decision You are about to make as if it was a failure.

For example, optimism usually peaks before entry. Even though our long term win rate is around 40%, we behave as if every trade was a winner. Consequently, we tend to oversize positions and delay stop loss.

Practice this powerful exercise for a month: just before entering a trade, imagine it will be loser that will have to be stopped out. Visualise yourself closing the trade at a loss, use the present tense. It may seem crazy but it accomplishes two things:

- Conservative position size: if you enter a trade expecting it to be a stopped out, You will naturally take smaller bets. You will stay out of illiquid issues

- Pre-packaged grief: we normally expect trades to work. When they don’t, we grieve our way to stop loss (Kubler-Ross). We negotiate with the inevitable. Now, if we expect every trade to fail, those which work will be good surprises. That do not perform as expected. It removes the emotional toll.

7. Execute the stop loss: re-parenting

A stop loss is just like any other trade. The difference is the meaning we assign to it can be potentially devastating.

The paradox is that beating ourselves up over losses reinforces the ego. Think of it as an orphan. Children have superb natural resilience. Beat the orphan, shame him, and he will retreat further, deeper. He will drape himself in the warm mantle of anger and call upon his resilience to endure the hardship. The orphan will endure but the child will yearn for forgiveness and love.

There is a link between self-forgiving and learning. Students at U-Penn who were taught to forgive themselves for their lack of assiduity have sh

own 10% additional retention and 15% better grades than those who were instructed to enforce rigorous discipline. People who forgive and love themselves when they have trespassed their own boundaries tend to learn from their mistakes. In Jungian archetypes, this is the Ruler bringing back the orphan to the committee of the mind and thanking him for his protection. In other words, soothe yourself as if You were talking to your child. This is called re-parenting the orphan.

So, the more You forgive yourself, the less daunting stop loss becomes

The easier it is to execute stop losses, the easier to take new trades

The smoother the execution, the better the performance

Bottom line, forgive yourself for your mistakes and You will become a better portfolio manager.

In conclusion, watch this excellent video from Nobel laureate Daniel Kahneman on mistakes and pre-mortem

Let’s reframe the question: can You be a top pro athlete while having a 9 to 5 job?

Let’s reframe the question: can You be a top pro athlete while having a 9 to 5 job?

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.