January 2016 was a difficult month for investors. According to Barry Ritholtz:s, 93% of investors lost money. Feeling helpless and crushed while watching your investments melt away is a terrible feeling that takes a devastating toll on emotional capital. There can’t possibly be anything worse feeling, except perhaps a skill aspiring short sellers have to master, humility.

If You want to profit from a bear market and if You want to hold your short positions long term, then You probably should read this article.

Turning away from the gates of Valhalla

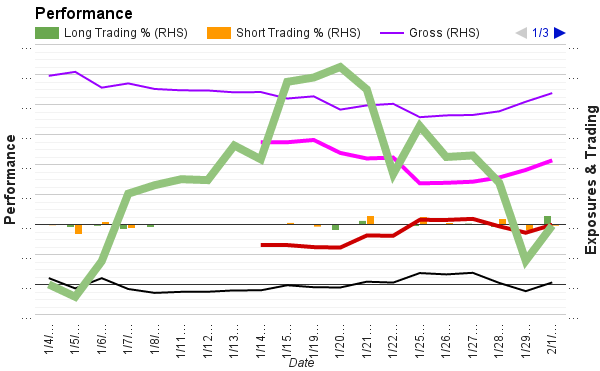

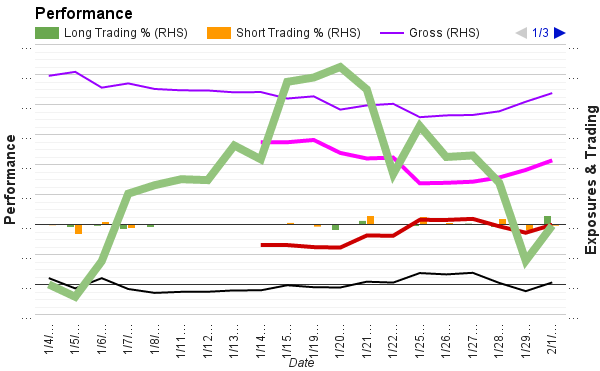

In January, my performance roared out of the gate. i was up at around +5.9% mid-month. i was timidly positioned for a cautious slow start with a gross around 150% and -0.12% risk per trade. Despite being ridiculously conservative and vastlyunder-participating, performance was there day after day. Returns were not only one-sided either. It was quality performance : Longs pulled their weight too: sugar, gold, Fixed income, Forex USD Bull. This is the stuff hedge funds are made off. i have long argued that the secret to AUM is to perform when no-one else does. This was it. And then, i saw it coming. i even wrote a post about it on the first day it happened, January 20th . A short-squeeze was under way. At this point, i could have closed all positions, walk away with +5.9% and be the one who closed right at the bottom. The gates of heaven were opening: Valhalla, shiny and chrome.

But then, i did the unthinkable. i went to work, methodically reducing bet sizes. i chose to take as little profit as necessary. i chose to forfeit all those profits and promises and then sat by the side of the road, waiting for the market to humble me all over again. And sure enough it did. It peeled off rock star returns, money for my family, fame, marketability, anything anyone would have aspired for. By the time Mrs Market was done with me, i had lost 90% of my gains: i went from +5.9% to +0.59% in less than a week. i was humbled alright, but i ended up profitable still. More importantly, I am better positioned now for round 2. Humility is a critical skill and below are the lessons from my journey

Two certainties in life: death and short squeezes

There are two certainties in life: death and short squeezes. There is no way to predict how long, how brutal short squeezes will turn. Why they happen is irrelevant: exhaustion of selling pressure, irrelevant but reassuring good news, government gesticulation, monetary intervention. Whatever the reasons, short squeezes are part of the short landscape and i have to deal with them.

Someone told me that short selling a stock at $1 can still yield a juicy 50% return if it drops to 50 c. True, at least in theory. The real question is would he still be there after price rallied from 52 c. to 70 c., or 30% in 4 days ? Very few people have the testicular fortitude to hold steady. i don’t, and this is why i have developed a methodology that enables to ride short squeezes.

The triple R methodology to weather a short squeeze

Short squeezes happen with 100% certainty. It is not about if, only about when. Rather than thinking of them as pestilence, i came to appreciate them and make good use of them. After all, they provide good entry points, plentiful borrow and flush amateurs (it is hard to feel sympathy for impatient people who jump in the water after vaporetti). Without further ado, here is the triple R methodology:

- Reduce: bet sizes as soon as You perceive a short squeeze

- Ride the squeeze. Do not short sell on the way up, but trim Longs that got clobbered in the downturn

- Reload: once the squeeze fades: lower stop losses and top-up existing positions

In practice, it looks like the chart below:

Reduce

i am a trend follower. My objective is to ride positions as long as trends are valid. So, as soon as i see a squeeze coming, i reduce risk. i cannot control how vicious and how long they will last, but i can control how much damage they will inflict to the portfolio. So, the first step it to reduce bet sizes, so as to capture some profit and reduce subsequent potential damage.

Whether You trade German Bunds, US equities or colorful language with your significant other, You deal in one thing: risk. Risk is not a story. Risk is number. Since there is no way to predict how unpleasant a squeeze will be, it is prudent to bring risk to neutral as soon as You see it happening

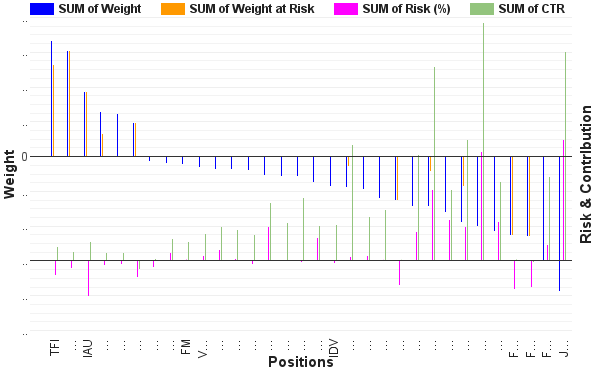

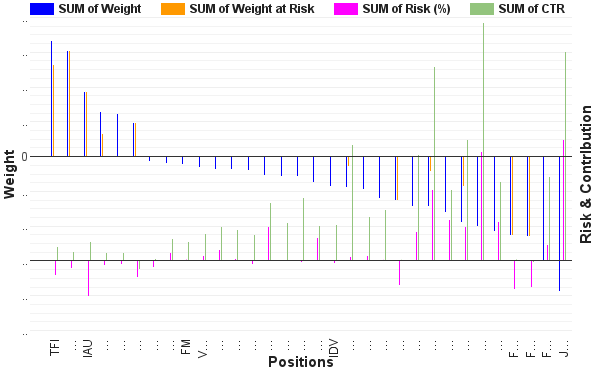

Above is a picture of my portfolio in late January:

- Open Risk (pink bars) = Shares * (Cost – Stop Loss) / NAV

- CTR (Contribution, light green) = [Shares * (Price – Cost) + Realised P&L] / NAV (Scale out model, hence realised P&L)

- Weight (blue bars) = Market Value / NAV

- Weight at risk (orange bars) is weight (blue) where Open Risk (pink) is still negative

In simple terms, i try to bring the orange bars to neutral. At the onset of a squeeze, my objective is to have as many positions as possible with a neutral or positive risk carry. There are several ways to do it, but if You are new to the method, just halve your positions. Example: if You have -0.50% open risk and +0.25% profit, halving the position will reduce risk by a factor of 4: from -0.50% to -0.125%.

Important: make a note of the mental chatter while You are closing your positions. Which side wins: fear with “close it all, You don’t know what tomorrow is made off” or greed “just one lot, and leave everything on the table, that’s the way to get rich”. This mental chatter is an important window into your psychological market make-up. Journal your thoughts and emotions, You will find treasures

Ride

“Everybody’s got a plan until they get punched in the teeth”, Mike Tyson Mysteries

Now that all the hatches are closed, that i am safe and sound in the cockpit, time to find this bottle of stiff spirit and roll with the storm. The only permissible trades are Longs: close poor performers during squeezes and buy resilient stocks as they underperform.

The hard part is to accept to let go of your paper profits. You have to accept that short squeezes will come and go, that they will wreck your portfolio and that You will have to watch it happening and keep calm. This is part of the game. Roll with the punches.

Important: Journal your fears. There is a tremendous wealth of information here. This is an exceptional opportunity to learn about what makes You tick.

Reload

“it is not about how about hard You can punch, It is about how hard You can get punched and keep coming back”, Rocky Balboa

The whole purpose of the method is to go past the squeeze and reload. Alright, i got humbled, but i am still standing and now it is my turn to hit back. In the above chart, the positions with long green bars have gone through multiple stages of reduce/reload. Australia, Junk bonds, oil, natural gas and Jim O’Neil’s BRICs have delivered over time.

Once the squeeze is over and stocks start to roll over again, it is time to:

- Reset the stop losses lower: swing high + n * ATR

- Reload existing positions

- Reallocate resources to new promising shorts

Example: SPY was entered at 202. It represented -3.8% of the portfolio. Only 0.8% was necessary to cover so as to ensure break even on the remainder position. Previous stop loss was at 209.92. Current stop loss is at 201.23, below cost. This gives +0.15% of positive risk carry to be deployed to another tranche of SPY.

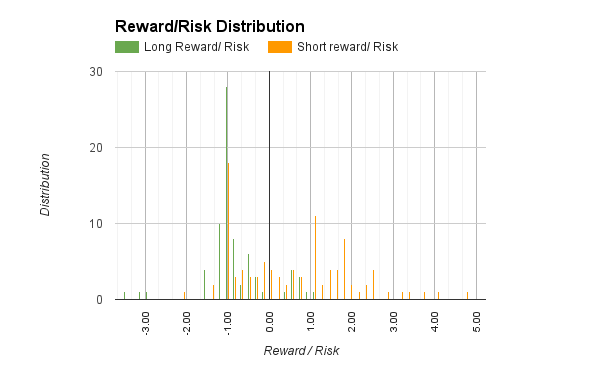

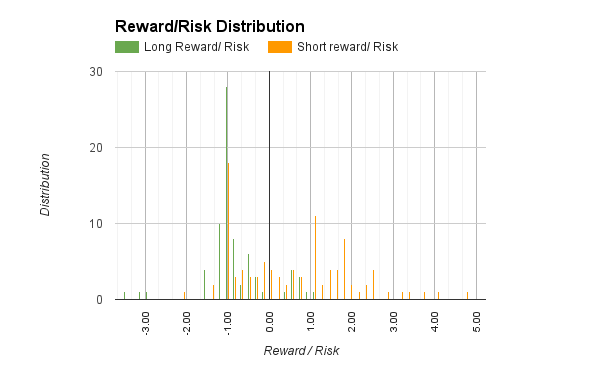

Short-selling is not like Long buying: You cannot buy once and throw away the key. Shorts shrink, so You have to keep topping them up. Every time a stop loss is lowered, residual risk decreases. This goes far beyond eliminating risk. Positions continue to accumulate positive carry along the trend. This gives a distribution like the chart below where best performers have 5:1 reward to risk.

The -1 peak stands for positions being stopped out. Failure is the primary ingredient of success.

-2 and below positions are positions that woke up way below their stop losses. EWM was a good case in point: i closed a Short, open a Long and a week later the position lost 30% overnight. Volatility was high, so size was small anyhow. It was unpleasant but not hurtful.

As You can see, the methodology is simple: reduce risk, ride the storm and reload. Yet time and again, i have failed to execute and in the beginning at least so will You. Now, would You like to know why ?

Marshmallows, or why i used to fail to execute a simple methodology as the triple R

90% of trading is mental, the other half is just good maths. The triple R methodology relies on three principles

- Commitment: this methodology only works if i am committed to hold your positions long term. If i just want quick gratification, i will take profit too early and never allow them to fully mature. Similarly, i would never have the stamina to be slapped around so much

- Clear trading plan: commitment is directly proportional to the clarity of the trading plan. People don’t fail because they don’t have a plan. They stumble because they have complex ambiguous ones.

- Mental reframing: We are hardwired to do the exact opposite of the triple RLoss aversion: Kahneman Tsversky have demonstrated that we are risk adverse with profits and risk seeking with losses (i am writing an awesome must-read & practical post about this + Jungian archetypes and neuro-chemistry BTW, so stay tuned)Process versus outcome: performance is the outcome of a good process. delayed gratification: the single predictor of success in life is whether You will eat the marshmallow. Behind the adorable cruelty there is a profound principle Faith: it is simply the perseverance to trust and execute a plan. In the Jungian archetypes, those are the resilience of the orphan combined with the vision of the magician and the discipline of the ruler

Beyond the fascinating academic research on the brain, i came to find a simple conclusion. The reason why i failed was poor habits. As soon as i became conscious of my habits, i became able to fashion new ones. A simple habit is to reset stop loss. Another is to take profit at the onset of a rally. A third one is strict position sizing. All those habits have fashioned my investing style.

So, when the short squeeze was upon us, it was not hard to step aside and let it pass, however petulant it could be. It is a habit now.

Conclusion

“if You can meet triumph and disaster, And treat those impostors just the same”, Rudyard Kipling

The short side is the Antarctica of the markets. It is out there, not too far from civilization, but vastly unexplored at the same time. My stance on short selling is simple: if You think a stock is short, don’t fool people with writing a book about companies fooling people, don’t talk your book to Bloomberg reporters, don’t sue companies. Just locate some borrow, place the trade and let the market give its verdict. Those are no market wizards strategies, those are marketing wizard gimmicks.

Being a good short seller requires a lot of humility. A short squeeze is always around the corner. It takes a lot of strength to forego instant gratification for the sake of long term rewards. So, when the month ended at +0.59% instead of +5.9%, did i feel bad ? Of course, it hurt, but then: Mr Short Squeeze, is that all You got ? Now, my turn…

Tourists short sellers often short stuff that does not make sense anymore. They go after crazy valuation, parabolic momentum etc. They may be right in theory, but they are invariably wrong in practice. One sane person versus an irrational mob is still an unfair fight.

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.