Most market participants look at the short-side through their Long Only perspective. They believe that if they apply the same logic that has made their success on the long side to the short side,

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.

Stage 1: Contrarian shorts: from stratosphere to ionosphere

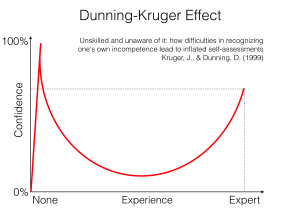

Market participants often come to short selling from the Long side. They believe in fairness. What is cheap should progress to fair valuation. Conversely, what is expensive should revert to fair valuation. Fairness is one of the very traits that transcends culture, race, and age. Toddlers have deep sense of fairness, long before they can speak. We are hardwired for fairness in a world that is not. Carrying that subconscious belief in the markets is a deadly virtue.

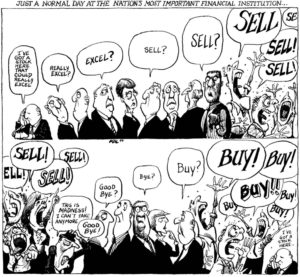

Market participants often see themselves as the lonely voice of reason amidst a delusional crowd. They may be right, eventually, but meanwhile one single individual battling a mob is still an unfair fight. Stocks that have reached stratospheric valuations often have enough momentum to push to the ionosphere, before gravity reels them back in. Stocks on PE of of 100 have escaped the gravity of reason. They might as well go to 150, 200 or 3000. This is the rarefied atmosphere of permanently high plateau, paradigm change, because like before, “this time, it’s different”

Short selling something that does make sense does not make sense either. As Keynes used to say, markets can stay irrational longer than we can stay solvent.

From a portfolio construction perspective, this does not make sense either. On the long side, market participants expect fundamentals to improve and stocks to go up. They are in for the long haul. Meanwhile, on the short side, they expect imminent collapse. So, they are Long trend following and short mean reversion. Those have diametrically opposed reward to risk profiles. They have different P&L distributions and different sets of risks. Risks that are different do not cancel each other out but compound as they quickly realise. It is always painful to watch a short book accelerate faster than a dull long one.

Once market participants re-acquaint themselves with the old adage “the trend is your friend”, they are scarred enough to move to the next stage.

Stage 2: crowded shorts: the province of fundamental short sellers

The last 5% around the top and the bottom have claimed more market participants than the 90% in between.

When short selling by anticipation fails, market participants turn to shorting by confirmation. They wait for fundamentals and newsflow to deteriorate enough to place a trade. They have been scarred before, so they want every box ticked, every fact checked.

What they fail to realise is that if there is sufficient evidence to conclude that it is a short, there has probably been enough warning signs for long holders to bail for some time.

By the time short sellers have accumulated sufficient evidence to build a short case, long holders have left the building. Short sellers are left battling with one another over a dry bone. Those shorts make sense, but they rarely make any money.

In fact, the reward to risk curve has inverted. Outcome is binary: either stocks goes to zero, either there is some corporate action: takeover, management change etc. One of my London ex-colleagues used to say that a distressed stock going from 1 Euro to 50 cents is still a 50% decline. True: 1 to 0.50 is -50%, but only after 6 or 7 nasty short squeezes. The question is not whether stocks will get to zero, the question is will you still be there by then ?

In my time as a dedicated short seller, brokers used to call and pitch “structural shorts”. Structural shorts trigger a deep seated Pavlovian reflex: it makes me want to

- buy the stock

- graciously offer the borrow for free

- and send a box of chocolate to whomever wants to short. Chocolate is a good therapy for smoothing the rough short squeezes ahead

Stage 3: Frustration and the despair of structural shorts

Contrarian shorts hurt. Fundamental shorts do not contribute much either. At this stage, market participants realise that the beliefs they hold about short selling may be right in theory, but still losing money in practice. Frustration and despair sets in. They have a couple of shorts and “hedge” their portfolios via futures. At that stage, market participants have literally no idea on what and how to sell short.

What happens when we lose your car keys in a dark corner of a parking lot? We go and look for them under a lamp post, where there is light of course. Market participants look for those structural shorts that will go down forever so that they can throw away the key and go back to their longs.

Market participants who publicly profess their hunt for structural shorts are unfit for managing people’s money for two reasons:

- Divorce from reality: Structural shorts are like market gurus: they are a dime a dozen. Profitable structural shorts are like market wizards, good luck finding one. Borrow is expensive and long holders have left the building a long time ago

- Abdication of responsibility: when they say they want structural shorts, what they mean is they do not want to be bothered with the short side anymore. They want to find something that they can throw in the short book and “forget about it”. This is an implicit acknowledgement of failure. They are happy to collect fees, but reluctant to do the work. There is obviously no hedge, no downside protection, no free lunch and eventually no happy ending.

At this stage, market participants resort to futures. They realise their vulnerability both versus the markets and versus their investors. The problem is futures do not offer much protection when markets tank. Besides, investors are understandably reluctant to pay exorbitant fees for something they can do themselves. They are willing to pay as much

Stage 4: Unplug from the matrix: reality is the time in between the “shoulds”

Between the time when Valeant was puffed up to “unsustainable valuations”, and the first analyst to throw the towel with a “Sell” rating, share price actually did go down by roughly -80%. There was no “beam me down Scottie”, exchange between share price and the deck of the Enterprise. Share price did go down over time, but market participants were institutionally blind to it.

Persistent short sellers one day wake up to the fact that between the time when “valuations should normalise” and when “company should collapse”, there is an extended period of time when share price actually does come down. Reality is the time in between the “shoulds”.

Stage 5: DARP: the un-sexy flip-side of GARP

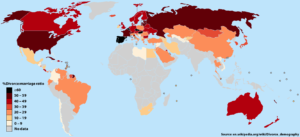

Under-performing stocks are everywhere. They rarely reach extreme valuations, so they never feature on everyone’s target short list. They just trail their sector, the benchmark and eventually drop in absolute as well. They just slowly fade into oblivion, and this is why we have a collective institutional blindspot. There are three main reasons for this: psychological and wrong assumptions

Analysts color blindness

Analysts are color blind: everything has to be either rosy or dark grey. They are usually prompt to raise their ratings and their estimates when fundamentals improve. They are late to downgrade their ratings as they do not want to jeopardise their relationships with corporations, infuriate their investment banking colleagues and volunteer for the next chopping block. Estimates fall but not nearly as fast as they were once raised. There is built-in institutional inertia to factoring decline in ratings and estimates. Meanwhile, old stock market darlings just drop off the conversation and gradually fade into oblivion.

The second reason is psychological. As scientific as it may sound, fundamental analysis is inherently subjective. Facts just aren’t data; they are weaved into “logical” arguments called investment thesis. For fundamental participants to admit a stock could be a short, they must first go through the intellectual divorce of accepting that it is no longer a Long.

Fundamental market participants grieve their way into short selling. They go through the Kubler Ross cycle of grief. Only in the final stage do they finally wake up and accept that the stocks they once loved could be short. Everything prior is discounted, or ratonalised.

DARP: the un-sexy flip side of GARP

Many market participants invest on the Long side following a Growth at Reasonable Price (GARP) methodology. They look for visible growth prospect with reasonable valuation support. They shy away from hyped stocks.

Frothy valuations is the premium market participants put on growth prospects. Once growth prospects disappoint, the premium gets arbitraged away. Valuations come down to reasonable level, on par or at a slight discount versus their peers. This gives the illusion of fair valuation or discount relative to peers. There is no news flow that would draw attention, such as big earnings revision, or product recall. Yet, growth may continue to be sluggish. Growth stocks move to the value camp, and value stocks drift to value traps. Stocks imperceptibly under-perform their peers, the market. Welcome to the world of Decline at Reasonable Price (DARP).

This notion of DARP is difficult to comprehend for most fundamental investors. They practice Growth at Reasonable Price (GARP) on the Long side. So, they believe they should do the opposite on the short side. They naturally tend to look for unreasonable valuations coupled with unsustainable growth prospect, or even imminent collapse. As we saw before, the last 5% to the top and from the bottom have claimed more participants than the 90% in between.

Investors struggle to find shorts because they look for the wrong clue. They focus on rich valuations when they should look for relatively sluggish growth. This puts a glass ceiling on share price appreciation, i-e the famous “valuations stay cheap for a reason” argument.

In a nutshell, there is no smoking gun on the short side: profitable shorts do not stand out. The best way to picture a profitable short is to think of it as dull long stocks. On the short side, boring is good. Boring under-performs.

Conclusion: Empty your cup

The short side is is a vastly unexplored continent: the Terra Incognita of short-selling. It has its rules and its dynamics, largely unexplained.

Market participants come to the short side full of the assumptions they carry over from the Long side. The theory that they bring along has a sobering encounter with reality. This brings frustration, disappointment, anger and eventually atonement.

Yet, success on the short side carries its own rewards. Those who master the skill can craft their own performance profile, levy higher fees, attract and retain investors.

The short side has more than one paradox. Whilst volatility is elevated, success comes from looking for stocks that other investors casually dismiss as boring.

Let us know what You think, your experience. Comments are always welcome. Please share with your friends and colleagues

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.