10 myths about short selling

Steven Spielberg’s movie Jaws has changed forever the way we perceive sharks. Did you know that deep in the comfort of your house lies something 150 times deadlier than any great white shark ? The probability of dying falling out of bed is 1 in 2 million. The probability of dying as a result of an exploratory shark bite is 1 in 300 million. Fortunately, we are not on the menu; sharks apparently don’t like junk food.

Like sharks, short sellers are fragile and misunderstood creatures. They are not the nefarious speculators. We are your pension’s best friend

[This is one of the chapters of the upcoming book: “the wisdom of short sellers”. We value your comments and feedback. So, please, help us helping You]

Myth 1: short sellers destroy your pension

Would it be fair to say that people who hurt your pension should to be fired ?

According to www.Spiva.com, around three quarters of active managers trail their benchmark year after year. Your pension account is therefore better off with passive funds rather than expensive active managers. In bear markets, active managers might claim they outperform their benchmark, when the reality is they still lose money.

Your pension account does not need short sellers in bull markets. During bear or volatile markets, short sellers do make money. Counter-cyclicality is in the job description. So, all your pension account need is an allocation algorithm (see chapter on asset allocation by trading edge) to deploy between passive long funds and active short sellers.

Conclusion: Who is your friend ?

- Long Only active managers who have a sustained long term track record of hurting your pension

- Short sellers who will make money when the going gets rough.

Isn’t it fair to say that short sellers should be your pension’s new BFF ?

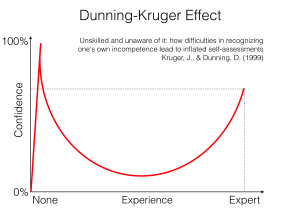

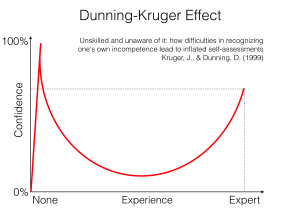

Myth 2: Short sellers destroy companies

The wisdom of short sellers is rarely welcome at executive boardrooms. As a result, they cannot bring healthy balance to the Dunning  Kruger (*) dark side of the force. Senior managements at companies like Apple (round 1), Lehman Brothers, Kodak, Enron, GM, Volkswagen are perfectly arrogant, incompetent and stubborn enough to run their venerable institutions into the ground themselves. Short sellers do not compound sub-optimal executive decisions, otherwise referred to as stupid mistakes. They see something going down and just hop on for the ride.

Kruger (*) dark side of the force. Senior managements at companies like Apple (round 1), Lehman Brothers, Kodak, Enron, GM, Volkswagen are perfectly arrogant, incompetent and stubborn enough to run their venerable institutions into the ground themselves. Short sellers do not compound sub-optimal executive decisions, otherwise referred to as stupid mistakes. They see something going down and just hop on for the ride.

Kruger (*) dark side of the force. Senior managements at companies like Apple (round 1), Lehman Brothers, Kodak, Enron, GM, Volkswagen are perfectly arrogant, incompetent and stubborn enough to run their venerable institutions into the ground themselves. Short sellers do not compound sub-optimal executive decisions, otherwise referred to as stupid mistakes. They see something going down and just hop on for the ride.

Kruger (*) dark side of the force. Senior managements at companies like Apple (round 1), Lehman Brothers, Kodak, Enron, GM, Volkswagen are perfectly arrogant, incompetent and stubborn enough to run their venerable institutions into the ground themselves. Short sellers do not compound sub-optimal executive decisions, otherwise referred to as stupid mistakes. They see something going down and just hop on for the ride. (*) Dunning Kruger effect is a cognitive bias in which people are so incompetent that they actually believe they are talented. This affliction is quite prevalent with senior management operates at such altitudes in the layer cake that they incorrectly believe it does not have to stink any more. This is reinforced by an obedient bozocracy, bureaucrats whose sole “raison-d’etre” is to vigorously acquiesce.

Myth 3: Short sellers manipulate markets

Back in the days, a celebrity hedge fund titan used to publicly announce his investments in Japan. During the ensuing rally, retail flow remained strangely net seller, despite all the hype on investment blogs and chat rooms. Moreover, after-hours dark pool activity showed big blocks were exchanged. Someone was going through great length to discreetly unload a big position…

Had this manager done the exact same thing with a short instead of a long position, he might have attracted a different kind of attention. The public and the regulator do not take it kindly when someone publicly short sells across the nation pension funds large holdings. If You are a short seller, You will be audited. So, it is in your own self preservation best interest to strictly abide by the Law at all times.

If your business model revolves around putting on big short positions and then talk your book, then stop reading this, go buy some coffee mugs and lots of cheap coffee, because “los Federales” are on their way.

Myth 4: Short sellers want the demise of the economy

As we will see in this book, short Selling is a relative game. It comes down to selling the stocks that trail the index and buying the ones that outperform it. There is nothing nefarious about this type of arbitrage.

When market participants turn a bit more risk adverse, speculative stocks tend to come down harder and faster than the boring ones. Your average pension fund manager certainly had initial healthy professional skepticism as to the long term prospects of www.pet_cemetery_in_outer_space.com internet start-up or www.cash_crematorium_diagnotics.com biotech venture. Yet, he just felt pressured into buying, because everyone else did and he did not want to be left out trailing the index. This would cost him his job. Now, that things have hit a bit of a “soft patch”, he is left scrambling to liquidate this toxic nonsense. It is unfortunate that pension accounts end up littered with hollow buzz stocks, but again, short sellers are not responsible for other managers suboptimal investment decisions. They just short-sell underperformers.

Myth 5: Short sellers destroy value

Short sellers do not destroy any more value than shareholders create any. If You buy a house, a car, a pen today for 100 and resell it tomorrow for 105 without having done anything to improve it, You have not created any value. You have just made a profit of 5. This comes from a confusion between market capitalisation, value and valuation. The press likes to associate market capitalisation going up or down with value creation or destruction. Warren Buffet said: “price is what You pay, value is what You get”

Myth 6: short sellers are responsible for the collapse of share price

Short sellers need to borrow stocks in order to take short positions. Borrow availability is usually between 5 and 10% of the free float, or shares publicly traded. This represents between on and two weeks of trading volume. Short sellers do not have the fire power to durably affect share price.

Short sellers and big mutual funds have access to the same information. Share prices collapse as result of Long-Only heavy artillery selling, not small time short selling BB gun.

Myth 7: Short sellers accentuate market volatility

Some jurisdictions ban short selling. As a result, buyers can only purchase from a long seller. Sellers can only sell to Long buyers. This widens the bid/ask spread, which increases daily realised volatility. Market participants sell short for different reasons. It is often a way to hedge other transactions such as options, convertible bonds, preferred stocks, baskets etc. Inability to sell short reduces liquidity, increases volatility and ultimately penalizes all market participants. Banning short selling is often a sign of immaturity.

Myth 8: short selling increases risk

In theory, unsuccessful shorts can rally multiple times but only drop by 100%. Short-selling is risky, no doubt.

Yet, adding a short book to a long one reduces correlation to the index. It reduces portfolio volatility. The ability to sell short enables alpha generation not only in up but in sideways and down markets.

Think of it as boxing. If You stepped into the ring with Mike Tyson, and chose to punch only with your right hand, what was a tough fight to start with, will be a brief one too.

Myth 9: I don’t need to sell short during bull markets. I will just put on some shorts when the market turns bearish

Short selling is a muscle. It atrophies when not exercised. It is safer to learn the craft during bull markets when the long side can sponsor the tuition. Waiting for the bear market to show up is too little too late. It takes time, effort and money to master the skill, especially the mental side of short selling. Meanwhile, investors are notoriously impatient during bear markets. “the best time to repair the roof is when the sun is shining”, JFK

Myth 10: Short selling has infinite downside potential

If short sellers allow their positions to go up against them multiple times, then they deserve to be un-apologetically weeded out. Short-sellers is an extreme market sport. Joe Campbell got famous after breaking the three basic rules of short selling:

- always place a stop-loss: if You don’t have an exit plan, then You will not like what the market has in store for You

- control risk through position sizing: the most important question about fund management is: would You rather earn less than You could or lose a lot more than You should ?

- stay away from crowded shorts like penny stocks: risk is a binary event: either bankruptcy or recovery.

[Comments, feedback are uppermost welcome. This is a collaborative effort]

Leave a Reply

Want to join the discussion?Feel free to contribute!