#Quora: If 90% of traders lose and 10% wins, are those 10% disproportionally made up of very high IQ people?

If 90% of traders lose and 10% wins, are those 10% disproportionally made up of very high IQ peop… by Laurent Bernut

Answer by Laurent Bernut:

No, but for different reasons that the instructive and brilliant answers given by people far more intelligent than yours truly. Making money in the market is a side effect. Yes, You read correctly. Would You like to know why ?

(An entire section of my upcoming book on short selling is devoted to this topic so stay tuned)

To all of You who believe markets are efficient and think of yourselves as rational investors, how many times did You check your mails today ? 10–20 times. That is Dopamine in action. This is the reward circuitry. Not even Paris Hilton has a life exciting enough to check mails continuously. We do so because our brain releases dopamine (feel good hormone) for mild uncertain rewards.

Have you ever found yourself overriding your risk limit just right around the wrong time? Overconfidence is the ubiquitous plague of traders. Rational investor, would You like proof of overconfidence? Divorce statistics, i rest my case with your multiple ex-wives

Now, when your performance sinks and you can’t think straight, do you pass up trades? Do you find yourself exhausted, irritable? Cortisol

Your average pension fund manager is the direct descendant of someone who woke up in a cave and started running after mammoths for breakfast. Not exactly savvy with probabilities but the survivors got the girls…

The hard wired mind of trading

In the 60s Michael Gazzanika developed the theory of split brain. We, humans, pre-consciously rationalise our decisions. Take a look at the junk in your portfolio. A solid third of it would not even be there if you had to do it all over again.

Do You find it hard to execute stop losses (Oh, the chapter on the psychology of stop loss is worth the entire book multiple times, i will refund anyone who does not have a aha moment there) ? Ego prevails over profits. Valeant (VRX), case in point…

Subconscious beliefs and fears

Fears exist in the shadows. In his book, Daniel Goleman (the EQ dude) describes elf deception as a built in mechanism that covers its own tracks. we rationalise all the time. Proof? when was the last time you got laid (Maslow pyramid about reproduction)? when was the last time you rationalised a decision ?

Market participants do not trade to make money. Proof?Look at the junk that fester in your portfolio… Some of us trade to prove to someone dead 20 years ago (i-e father, mentor, bully at school, whatever) that they are worthy individuals. Dude, You are beautiful, You are worthy of love.

The floating world of beliefs and fears

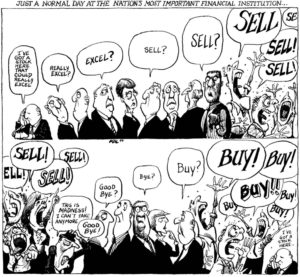

Finally, floating at the surface like ice cubes in a single malt are conscious beliefs and fears. Fears of losing your job, fear of missing out, fear of pulling the trigger, fear of inadequacy (smart guys are buying that Enron thing so i will join the party)

Of course, there is the belief You cannot time the market. Who told you that? Journalists and analyst who hug the mike and more importantly yourself when the thing you just bough went south…

Now, let’s quip the IQ myth. Self deception is a mechanism that covers its own tracks. High IQ dudes always have spectacular excuses. I know two types of traders: those who make money and those who have excuses. Which one are You

Bottom line: born to lose

Bottom line, your biology f@#ks you up. Your beautiful mind comes delivered with amazing features, most of which will get You killed on the markets (try fairness for instance). Then, your ego, your subconscious deep rooted fears will supersede your best intentions. Then, there is this floating junk of unchecked beliefs irrational fears.

So, no wonder 90% of the people lose money.

Now, why do 10% succeed? The hero’s journey

They succeed simply because of their inner alignment of their biology all the way up to their daily routines. Great traders are not smarter, they have smarter trading habits. Making money is just the yardstick of inner alignment.

Would You like to know about the three scientifically proven methods to re-align yourself? Then, please follow, or subscribe to my (free) website, or help launching the book

As Arnold, Ze Great Governator said: “Ze hardest part of putting on muscles is getting to ze gym, jaa”

If 90% of traders lose and 10% wins, are those 10% disproportionally made up of very high IQ people?