#Quora: What’s the biggest mistake that stock market investors make?

My answer to What’s the biggest mistake that stock market investors make?

Answer by Laurent Bernut:

Short answer: Absence of exit plan. The only soldiers who go to combat w/o an exit plan are Kamikaze. They don’t need one because they expect to die. Unfortunately so do a lot of market participants.

The apparent simplicity of the answer hides sophisticated concepts that can be broken down in two part: statistical and psychological trading edge

I Statistical trading edge

A Stock picking is overrated

Most market participants believe that stock picking is the alpha and omega of alpha generation. Stock picking is merely everything that precedes entry. It excludes bet size and exit. Unfortunately, stock picking has little influence on the statistical trading edge

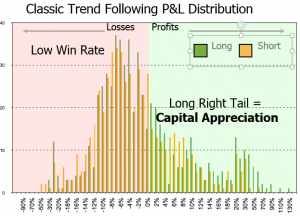

Trading edge = Gain Expectancy = Win% *AVG Win% – Loss% *AVg Loss%

1 Stop Loss is the most important variable in a trading system

Stop Loss has direct impact on 3 out of 4 components: Win%, Loss% (1-Win%) and Avg Loss%. Furthermore it has impact on trading frequency: the tighter the stop loss the higher the frequency and vice versa for Buy and Hope

Oops, this just proved that exit is the most important factor.

Please read further about the psychology of stop loss, even if you do not agree

2 Don’t call the race before the finish line

As can be seen, entry has some influence on Win% and Loss%, but nearly not as much as exit. The only time the amount of money that has been made/lost is known with irrefutable certainty is after exit, when open risk is closed

The corollary is that poor entry can be salvaged, poor exit can’t. If You do not have a proper exit plan, You will fail to appreciate the exit plan the market has in store for you

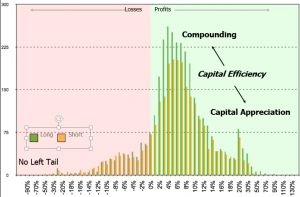

3 Money is made in the money management module

Secondly, Stock picking excludes bet sizing. Bet sizing is the most important determinant of performance

Here is an interesting story to prove this point. When I was at Fidelity, I was running my algo across all managers’ portfolios. My unbridled ambition was to help them trade better 0.05% at a time (multiply this 0.05% by 20 and you are in the rarefied atmosphere of outperformers).

It soon dawned upon my thickness that the same stocks were featured in in my esteemed colleagues’ portfolios. Nothing surprising there, everyone has access to the same research and there is healthy cross pollination. What was surprising was that despite low dispersion of holdings, there was high disparity of performance and volatility: despite owning the same stocks, some people were making a killing, while others were getting killed.

Conclusion: the difference that made the difference is not stock picking, it is bet sizing

4 Blow-ups and feed free-loaders

Watch your winners, but watch your losers more closely. Interesting story: i once had the opportunity to analyse multiple portfolios over many years across many managers on a trade by trade basis. The most important findings were:

- Winners look big to the extent that winners are kept small: If You exclude the worst three detractors, everyone would have outperformed the benchmark every year: 100% outperformance 100% of the time (before costs)

- Free loaders are performance killers: winners and losers are visible, so they get dealt with. The problem is to identify positions that are neither one nor the others, free loaders. They do not contribute enough to compensate for blow-ups and do not lose enough to be visible. They mobilise resources that should be deployed on productive assets. The psychological consequences is called capacity: you are at capacity when inertia sets in, when you do not want to take a trade because you think you are too big

The two issues that cause managers to underperform are directly related to Absence of EXIT policy

II Mental edge: 90% of trading is mental, the other half is good math

Optimism peaks before entry. After that, emotions kick in. The ultimate proof of this is divorce statistics…

1 Pre-mortem

Few market participants give bet sizing the importance it deserves. It is often either conviction (feel good) based or equal weight. Once they are in a position, things change. Or, more accurately, their perception change: they have either too much or too little of a stock.

The concept of pre-mortem is finally finding its way in decision making: Nobel prixe winner Daniel Kahneman, Dan Gilbert (positive psychology Penn U), Hal Hershfield (future self). The idea is to visualise the worst possible outcome and plan accordingly.

If for every trade You are about to take, you visualise a stop loss, something interesting will happen: you will size positions smaller. That is a natural reaction.

In other words, the most important question about fund management is: could i live with earning a little less than i could or could i afford to lose a lot more than i should ?

Again, the only way to grasp this is to mentally think about exit first

2 Kubler Ross: market participants grieve their way to selling

I am a professional short seller. On the short side, you make money by selling along people who liquidate their long position. You lose money by selling short crowded shorts…

There are many psychological charts about euphoria to despondency. They are all nice, adorable and lovely, but they are written from people whose perspective is to go Long. They do not understand the psychology of selling. There is one model that grasp the emotions we go through; the psychology of grief popularised by Elizabeth Kubler-Ross

Market participants grieve their way into liquidating losers and are too complacent when leaving winners.

3 The psychology of stop loss

Even if You do not agree with what you have read so far, You must read the post below.

All diets w/o exception have failed: statistics show that we are all getting fat year after year. Diets address the wrong problem. They talk about what we eat, not about how we relate to what we eat. Diets are a psychological issue, not a physiological one.

Stop Losses are exactly the same. They are an identity issue, not a statistical one. The ego associates being profitable with being right. So, losing money is an attack on the ego. We rationalise, change our beliefs (Festinger and ognitive dissonace, Gazzanikas and split brain theory) rather than kick out losers.

Read this post to learn how to reframe your beliefs and execute stop losses like you brush your teeth.

Conclusion:

Making money in the market is about having an edge. There are two types of edge: statistical and mental. The only ways to tilt your trading edge is to start with the end in mind: think about how you are going to exit before you enter

What’s the biggest mistake that stock market investors make?