These are questions from the audience on the Better System Trader podcast with Andrew Swanscott. I am honored and humbled by the interest of listeners. We did not have time to cover all questions, so here are some written answers. If You have questions, please feel free to ask

Trading Psychology

From: Jim

The mind plays tricks on us, even with a successful system, as a system trader, what methods to use for the mental part of the system trading? So meditation, journaling but how to implement them in one overall plan?

EXCELLENT QUESTION: Part 2 of the book will focus on this

- You cannot trust your mind. Michael Gazzanikas 1964 split brain theory. Self-deception: (Daniel Goleman) is a built-in feature. It happens automatically and covers its own tracks and designed to deceive us.

- Accountability: simple exercise to test validity of prediction and convince us we are unable to predict.

- Reframe from outcome to process: develop a system, account for signals generation and be honest about signal execution

- Daily market journal: write what You think markets, thoughts, things that happen, small comments, ideas, formulas. Do the James Altucher method: keep a moleskin with You at all times. Deliberate practice: activates the Default Modal Network (Olivia Fox Cabane)

- Write about the thoughts that cross your mind:

- dreams and aspirations when making money, why You keep doing that, why You like it. How does it manifest in the body

- fears, pains, detail, reflexes (ex: read the press, look for expert opinions): be specific and commit to writing or dictating. Very important

- Walk through your fears: meditate and manifest your fears. Seneca was history’s first investment banker. He also happened to be the founder of stoicism school of philosophy. He advocated one day a month of living frugally as a form of inoculation.

Another post on the topic:

From: @trader1970

So far as a Trader what is the biggest fear that you have not been able to overcome? How do you manage this situation?

- My father had a hemiplegia (brain stroke) when i was 7. He never regained motor skills and speech ability. We fell into severe poverty. As a result, I have a deep seated fear of becoming handicapped and not being able to feed my family anymore. Personal and vulnerable. Markets related fears I can deal with, I am a short seller, this is a versatile skill

- How does it manifest itself in trading:

- Diversify sources of revenue: we have a real estate business that generates enough to cover our primary needs. That provides peace of mind. My family is safe from harm

- Frugal lifestyle

- Systematically take less risk: when making sizing arbitrage ask yourself, would You be satisfied with earning a little less than You could or losing a lot more than You should ?

Position sizing

From: Bass

Tell us more about risk management, Volatility based Stops and position sizing.

- It really depends on your customers: Investors are like teenage girls: Teenage girls say they want a nice guy and they fall for bad boys. Investors say they want returns but they react to drawdowns:

- Magnitude: never lose than what investors are willing to tolerate

- Frequency: never be the last person investors think about before going to sleep

- Period of recovery: never test the patience of investors

- Risk is not a story, risk is a hard number: it manifests itself in individual trade risk per trade (RPT), in aggregates exposures. Example: Long small caps / short futures is synthetically residually Long large caps as the index is primarily composed of large caps

- Volatility stops: swings +/- 3 ATR. Volatility is as welcome as Kanye West at an award ceremony. Bad news, volatility is like Monsieur Kardashian bad manners: it is here to stay. Your job is to ride it and the way to do so is position sizing. For example, biotech and internet stocks are more volatile than department stores for example. So, size them accordingly.

- used in position sizing. Rank trades by size (bigger first) so as to go for better volatility signature

From: Derek

Hi Laurent,

I have been following your website ASC for quite some time and also your answers on quora. I have something related to an answer you had to a quora question In investments, does more risk really equal more return, in the long haul? Your answer immediately clicked with me and it logically made sense to me. Laurent – you may want to quickly summarize what the answer was before we move on to the next part of the question. I’ll ask you what the answer was.

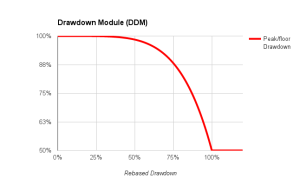

Would you please elaborate on your convex position sizing method for a risk per trade and draw down module. This was discussed as an answer on Quora. I understand that as you make money you will allocate a larger risk budget using a convex surface with a max risk budget of -0.30. But i do not understand the reverse side of this, the draw down part. As we get more draw down we should decrease our risk budget again using a convex surface. It starts at 100 and bottoms out at around 35. I do not understand how that part works.

Also how did you come up with this method? Can you give a practical example of when you used this both for drawdown and additional risk scenarios?

Thank you very much

Derek

Here is a complete article on the topic. Thank You very much for asking

- Long Side: people add risk. Short side; frequent squeezes, start from manageable risk then reduce

- Metaphor of accelerator and brakes. Optimum fuel consumption happens when You do not solicit brakes. It clicked while listening to Larry Williams interview on the famous Better System Trader after bringing my daughter to the Hoikuen (crèche in Japanese)

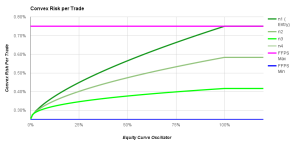

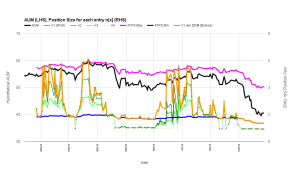

- Market Value (MV) = AUM * Risk Per Trade (RPT)

- Most position sizing formulas will use one side RPT usually to calculate risk. In my case, this is convex so as we make money take more risk. This is accelerator. You want this to be responsive and nervous so to re-accelerate quickly after drawdown

- Meanwhile, when strategy stops working, You need to trade minimum risk. The problem with conventional formulas is that brakes are spongy and re-acceleration slow. You can get whipsawed. Which then erodes emotional capital, which leads to downward spiral. (Feedback loop between emotional and financial capital). By allocating a convex surface, AUM drops dramatically very quickly but then re-accelerates as there are signs of life

- Practical example: ETF. At the moment squeeze so drawdown, then surface immediately reacts and I naturally trade smaller. Residual open risk in my latest short entry was -0.12%, down from min risk at -0.25%

Trading Edge

From: Marcia

During your interview in episode 32 you talked about the “Edge” formula, which is, I think, ” (%wins X Average Win) – (%Losses X Average Loss) “? Would you talk more about that and what number you are looking for, or, what insights the number gives YOU? thank you

Thank You very much. I am writing a book on short selling. Part 1 is about how to build a statistical trading edge. Part 2 is about building a mental trading edge. Part 3 is about constructing a portfolio with a positive trading edge. On the Long side, the market does the heavy lifting. On the short side, the market does not cooperate, so building a trading edge is critical

- I am looking for positive number. I have never looked for a specific number, thank You for the suggestion

- Use as asset allocation tool:

- Plot trading edge by side and strategy

- Pro-rate trading edge

- Allocate resources (trading AUM or surface) based on trading edge, with floor and ceiling

- This is useful for multistrats portfolios where You would systematically allocate resources to the best performing strategy

Shorting strategies

From: Adonis

What are the 3 most successful triggers he uses in going short? Does he use daily or weekly charts?

There were originally several variations on two strategies (mean reversion and trend following). Over time i have managed to merge them into one.

- Define trend: lower highs, lower highs

- Wait for roll-over: maximum information: volatility, swing high

- Enter on next bar

Exits:

- stop loss: full

- trend reversal (logical time exit): entry qualified on the other side happens within stop loss

- partial exit: risk reduction, take profit objective is to break even

Now, the delicate part is not in the signal module. Trading suspension for example is not a signal issue but a position size one. If sizes are too small, then trades are rejected. For example, sometimes currency pairs flip-flops between bull and bear. So, we count entries and add penalty for each full exit. This reduces risk per trade. If the overall equity is ain a drawdown, then position sizes get smaller. If they are too small, they are automatically rejected. This allows us to trade more pairs as some of them stop trading.

From: Graham

How do you simulate borrowing costs when testing a shorting strategy?

Everything at General Collateral (GC) +0,15% added to slippage. The question is probably related to hard to source issues or crowded shorts.

Do not short issues with borrow >5%, except on the Long side: squeeze box. Do not squeeze people: it is bad karma

From: Nikhil

1) Majority of ideas for a short strategies seem to fail rigorous testing on larger time frames so one should focus on more active time frames [5min to 2H based data] instead of passive time frames [Daily to Monthly based data] ?

Assumption: Nikhil may trade breakdowns, because this is a classic symptom or rebound higher than entry which leads to false positives.

Solution is not in better entry signal, but in partial exit and better money management, Trading system has 3 components: exit/entry, money management and mental.

2) Can you highlight a basic idea on a short strategies variable for further research for those struggling with constructing a short only strategy ?

Sure, check post on JNK attached. It is a scale-out/scale-in system.

There are 2 certainties in life: death and short squeeze. Use squeezes to your advantage

3) What opportunities do you see in the financial industry going forward for new generation of entrepreneurs (non trading/investing related) coming up ?

At the moment, everyone wants to be in the HF game. I entered the HF game in 2003 when it was still in infancy: a bunch of cowboys blowing stuff up in their kitchen. HF is bound for yet another healthy correction.

I believe the future to be threefold:

- Algorithmic assets allocation: fire your financial advisor. If You don’t know why, he probably does. Machines do a better job and they don’t get kickbacks…

- Separately managed accounts (SMA): open a brokerage account and let algo do the heavy lifting. Funds running costs are prohibitive. Besides, there is a proliferation of single brain cells parasites called compliance. They are the TSA (US airports officers) of finance: utterly useless at catching problems but extremely annoying

- Active management “soft patch”: SPIVA.com. The overwhelming majority of funds underperform the index and they are more expensive than ETFs. There is a gambler’s fallacy going on: ETFs have outperformed active managers so far, but the latter will be better equipped to navigate volatility and downturns. That is gambler’s fallacy: if managers failed to outperform during easy times, why would they even succeed during hard times ?

As for non-investment profession, I honestly don’t know

From: Ola

I am using market filters to keep me out of bear markets for my long only strategies for stocks, and I’m cashed up for periods of time. I find this a bit boring. What type of indicators or price action should I look for to create a short strategy to complement the long strategies? I’m looking for something simple and robust to be used on the daily time frame.

Best regards,

Ola

Check JNK trade attached. 1 Define trend, 2, enter on counter-trend move 3 exit partially as rebound comes

General trading

From: Bengt

Hello, it is often said that short trading is very difficult to make money off: Do you agree with this? If so, do you think it is a matter of the odds not being on your side or is it too much to handle mentally?

EXCELLENT QUESTION: “This is space, the environment does not cooperate… You solve one problem after another, and if You solve enough problems, You get to come home”, The Martian.

Andrew, Allow me to explain why people fail on the short side: they think from a Long perspective. This is deep shit that no-one has ever explained in statistical and psychological terms. Fascinating theme, I am writing the book on the topic and how to build a sustainable short selling practice

Example: 4 stocks: A,B Long C,D short, all start at 100

Start: Long exposure 200%, Short exposure: 200%, Gross exposure: 400% , Net exposure 0%,

A goes up by 10%, B drops by 5%. C drops by 10% and D goes up by 5%

End: Long exposure 205%, Short exposure: 195%, Gross exposure: 400% , Net exposure +10%,

Bottom line:

- On the long side, the market does the heavy lifting for You. There is a bigger bet on something good

- On the short side, the market does not cooperate: there is a bigger bet of something that does not work

- Net exposure is +10%. The main reason why people fail is that they want to short a throw away the key when they should be working more on the short than the long book. Just to stand still they should keep running: this is a Sherlock Versus the Red Queen effect

On the other end of the spectrum: is there an outer limit, odds-wise, for profitable long term trading, or is an 800-day breakout tougher to handle mentally than a 2 day breakout?

Best regards: Bengt

The problem is false positives: You will have many more false positives because of poor trend formation with shorter periodicity. You will deal with being systematically late. A more robust statistical approach is to deal with exits so as to move the needle from “near win” (false positive) to “near miss” (partial win)

From: Rob

Please ask for the following:

1) What works better in the forex market – momentum or mean reversion?

Mean reversion works until trend following works. It is a question of periodicity and tolerance for stop loss.

My strategy is a combination of both.

Post about two types of strategies:

2) If you had to start over from the beginning with the knowledge you have now where would you focus on and what would you throw away?

- Psychology: clarity about beliefs. 90% of trading is mental, the other half is good math

- Trading edge is not a marketing gimmick: it is a number

- Money management: example of convexity

- Exits: stop loss is the 2nd most important variable

3) You have said in the past to focus on exits and not entries – but how exactly do you do this? Is it a matter of thinking about when you will exit if you are right or wrong?

Never think about right or wrong, it is the wrong mental association that will lead to death. Think about profitable. I am writing something on the psychology of stop loss. This article is potentially the most or second most important post I have ever written.

The best analogy is diet. Diets don’t work. We are all getting fatter and there has never been as much information on diet. Diets fix the wrong thing. The problem is not what we eat. The problem is how we think about we eat. Same goes with stop loss and exit.

This is not a mathematical problem. This is a psychological issue about the meaning we ascribe to closing positions. If we associate stop loss with being wrong, the ego will revolt.

IAU option trade anecdote funny and excellent example to talk about emotional capital and Zibbibo viognier white wine blend from Etna

4) What do you think about fixed fractional position sizing

it is a good basis of any position sizing algorithm. Now, it is a bit simplistic for 2 reasons:

- Uniform risk taking through the cycle: think of it as a car. Sometimes it is good to accelerate, sometimes You need to decelerate. Win rate changes through the cycle and so should risk

- Dissociation: Long and short sides rarely work well at the same time. Since they have different win rate, they should have different risk numbers

Dissociation by side of the book, strategy using trading edge or win rate. Please check my post on convex position sizing

5) Please talk more about stops. you said in the past your stops have a large impact on your P&L – but how do you calculate your stops. What are the considerations when using a mean reversion vs momentum strategy and type of market forex vs futures.

Sure, happy to explain the equation

Now, for mean reversion strategies, the equation includes another variable: frequency. Let me give You a simple example. If you clock +0.5% per month and then have -6% month, it will take roughly a year to make that back if everything else works. So, a simple idea is to empirically come up with a patience factor. Example: never allow losses to be greater than 4 months of average profit. The difficulty though is correlation. Accidents travel in group.

Another important point on mean reversion, never trade open risk strategies. Example: short naked gamma. I was having dinner with some options portfolio managers friends. Short OTM gamma is still marketed to unsuspecting investors. Those are scams: they show consistent returns until they blow up

From: John D

I trade a long term trend following (trade every 1-3 months) system on stocks indices currencies and commodities. What type of exits would you use on this type of system?

Trailing ATR stop? Time stop? Both?

John D, You are right on all of them

Three stops:

I have developed something called box concept. Once in a trade, there are three possible scenarios:

- It does not work and needs to be stopped out. That is a floor or ceiling depending on whether You are Long or Short

- It works well and warrants some de-risking: take money off the table and leave a portion for the long right tail

- It goes nowhere: this immobilizes resources and needs to be dealt with

The concept is that whatever happens, it will trip one of the mines and will be dealt with. This is how it is done in practice

- Isometric staircase stop loss: swing +/– allowance for volatility. Markets do not go up in straight lines. They go up or down, retrace and resume their course. This method allows markets to breathe

- Partial trailing stop loss: take some money off the table so as to reduce risk, but leave a residual for the big trend. After taking some money off the table, it makes sense to re-enter and a add a little bit more risk.

- Time stop: buying power and trading frequency. Some stocks do not move enough to warrant either a stop loss or a risk reduction. These are the harder ones to spot. The solution is to timestamp them.

About timestamp: