We have enjoyed a synchronous long smooth bull market. It has been good to all participants. Yet, no bull market has ever boosted anyone’s IQ. If anything, this Fed sponsored bull market has made participants fat and complacent: low interest rates pick up the tab anyway. Now, that the Fed has decided to tighten the purse, things may get a bit more turbulent out there.

Short-selling is the most underrated skill on the markets. It is neither a nefarious conspiracy nor an anti-patriotic gesture. It is a rare, versatile and immensely valuable craft that will ensure your survival in the most turbulent times. Markets have dropped by 50% twice in the last decade. If You would like to retire on returns rather than stories, then this is something worth learning.

Why You should listen to me ?

“Too many people look at “what is” from a position of “what should be”, Bruce Lee, Chinese philosopher

These days, everybody seems to have an opinion on short-selling. Short sellers seem to proliferate faster than syphilis on a ship. I cannot but feel humbled in such illustrious company. I have been in the alternative space for 15 years (hedge funds and large institutions). For the past 8 years, I was a dedicated short-seller with Fidelity Japan.

These days, everybody seems to have an opinion on short-selling. Short sellers seem to proliferate faster than syphilis on a ship. I cannot but feel humbled in such illustrious company. I have been in the alternative space for 15 years (hedge funds and large institutions). For the past 8 years, I was a dedicated short-seller with Fidelity Japan.

My mandate was to underperform the inverse of the longest bear market in modern history: Japan equities. Every day, I woke up -100% net short, having to do worse than the worst market on earth, good morning. These days, it feels somewhat refreshing to be around -50% net short.

While every other freshly minted guru has some elaborate speech about how short selling should be done, I have earned my short selling-skills the hard way and I have the scars to prove it. It is all lovely and cosy but the only tiny difference is that in the real world You can’t hit the reset button after Game Over. So, Come with me if You want to live

Why should You master the craft of short-selling ?

There are three obvious reasons:

- The secret to raising AUM is to perform when no-one else does. So, if You are a professional in the alternative space, just remember that when it is Babylon on the markets, investors will worship the Jamaican Prophet His Almighty Bob Marley

- Markets go up and markets go down: why not profit from both ? It takes a little more skill, that’s all

- A stronger version of yourself: In the world of short-selling, the market works against You. Either it will forge excellence out of You, either it will crush You. It is that simple. So, even if You decide to stay Long Only, learning to sell short will undoubtedly make You a formidable market participant.

Why do most people fail at short selling ?

“In theory, theory and practice are the same. In practice, they are not”, Yogi Berra, American Philosopher

Market participants approach short selling the same way they approach long buying. They do their analysis, watch some of it being validated and then happily conclude it is just the inverse of going long. That all works well until it is time to put theory into practice.

A couple of short-squeezes that would turn Barry White‘s rich baritone into Barry Gibb‘s high falsetto, a couple of quarters of humbling losses down the road, and they conclude that short-selling is dangerous. What they do not realise is that on the short-side, the market does not cooperate, stock picking is just not good enough. Market participants fail to understand the dynamics and the mechanics of short selling.

On the long side, picking stocks is sufficient. The market does all the heavy lifting thereafter. Stocks grow bigger, everything works in tandem: they contribute more both in terms of alpha and exposures. Losers shrink and hurt less.

On the short side, the market works against You. Winning big literally means watching your portfolio shrink like a magic skin: You have smaller victories when successful and bigger problems when unsuccessful.

Picking stocks is just the start. The real work of extracting alpha comes after that. This is hard, frustrating work, when it works at all. This is why people keep looking for structural shorts all the time, something they can sell short and throw away the key. Structural shorts are like market gurus, they are everywhere. Profitable structural shorts are more like market wizards, good luck finding one. They are so rare they make Big Foot look like a frequent guest on the Saturday Night Live show. Welcome to the mechanics of short selling: scarce poor quality borrow leading to short squeezes, prohibitive interest fees and dividends payable.

The MMA of short-selling

Martial arts are a good analogy for the markets. If Long only was a fighting sport, it would be English boxing, Queensburry rules. If Short selling was a sport, it would be MMA, Vale Tudo. Floyd Mayweather is the undefeated champion of the world. He is a solid contender for the title of the best boxer of all times. Yet, should he face Conor McGregor in the octagon, MMA style, he would be dismantled, dismembered and disfigured long before the first round bell has a chance to save him.

On the Long side, all You have to do is pick stocks and the market does the rest of the work for You.

On the short side, not only do You have to do that, but You will have to master those skills:

- position sizing: successful shorts shrink, unsuccessful ones hurt fast. Learn to size position so that they may contribute if successful, but not wound if not

- Milk your ideas: successful shorts shrink. So, it is not enough to find them, You must constantly work at them to extract alpha

- Consistent idea generation: a healthy short book shrinks, so You need to come up with at least twice as many ideas as the Long side just to keep up

- Market timing: two certainties in life: death and short squeezes a la Barry Gibbs. Use the latter for trading purposes before the former catches up

- Superior understanding of risk: risk is a number, not a pretty paragraph at the end of a dissertation. Short sellers naturally develop a keen understanding of hedges and probabilities.

- Process versus outcome thinking: if investment is a process then automation is a logical conclusion

- Mental fortitude: would You like to be the iceman on the trading floor when everyone else panics ? After a while, bull markets, bear markets, they all taste like chicken

The good news is that short-selling is a skill. It can be acquired, perfected and expanded. It is also a versatile and valuable one. Remember this: with this skill, You can go Long without breaking a sweat, but can Long-Only do your job with the same ease

How does it work in practice ?

Short selling is a high pressure sport. Those who have only gone Long will suddenly be confronted with unfamiliar levels of stress. Volatility, uncertainty, fear, stress, pressure constrict the thinking brain (prefrontal cortex). Whatever mental bandwidth is left will be thankful for clear, unambiguous and simple instructions. So, do not be fooled by the apparent simplicity zen appearance of the charts. It took years to mature and thousands of lines of code to come to this level of clarity. In time, I hope You will learn to appreciate the gift of simplicity.

The above chart is designed to be intuitive.

- Price Bar colour: Down trends are coloured tomato. Uptrends are coloured olive. Back in 2012, the original name of the strategy was Olives & Tomatoes. (no wonder it initially failed to garner traction in my venerable institution…)

- Swings: swing high bars are coloured in green with a green annotation above the price bar. Swing low bars are coloured red annotation below the chart

- Annotations above/below swing bars:

- Olive (above) / Tomato (below):

- Stop Loss: Single number above/below all annotations

- Target price: target price is a risk management level. It is not an expression of fair value. Life is unfair, so are the markets, get over it

- #ATR: Average True Range [20 bars]

- Mauve (never trust a Frenchman with the colour code): Remaining balance. When engaged in a position, the algo calculates the quantity to exit so as to break even on the trade thereafter and prints remaining balance

- Dotted Green/Red Line: isometric staircase stop loss. Stop losses are reset for all positions. Those who fail to honour them will be unapologetically de-friended: may You be chained, eagles devour your liver and Justin Bieber fill your ears

- Black triangles: represent entries. Stacked triangles mean single entry, multiple exits. Above/Below is a precious roadmap that contain all the values for the journey ahead

- Ceiling/Floor: this is the equivalent of stop loss.

- LoB: is the equivalent of a Limit or Better price. Do not chase stocks past that point as probability recedes thereafter

- Red/Green inverted triangles: mean unprofitable/profitable exits. Stacked triangles mean final exits of multiple positions

- Moving Average: we all love our Christmas trees. This has no bearing on the strategy, but users have found it easier to anchor their beliefs around a long term moving average.

Charts have all the essential information You need to know to go on your journey: bullish/bearish underlying trend and exit roadmaps. It is kept simple by design. For example, position sizes have been removed in this version. They are calculated separately in the alert table. It all comes down to essentialist philosophy: focus on the essential few and let go of the trivial many. With this tool, You have a sustainable fighting chance against the markets.

Trading Journal

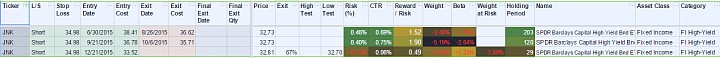

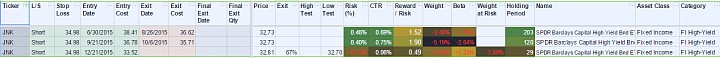

The above chart translates into real trading: multiple entries and exits. Green column is entry. Salmon is partial exit and grey is final exit. As soon as a position is entered, the first order of business is to take some money off the table so as to reduce risk.

Above is JNK, the ETF for high-yield bonds. When the first trade was taken, the chrematocoulrophony (chremato: money, phone: voice, coulro: clown) or consensus on The Street was talking about “Buy the dips”, “value hunting”. These days, everyone talks about the implosion of the high yield space. Bottom line, the hardest trades often offer the best rewards. Stick to your system.

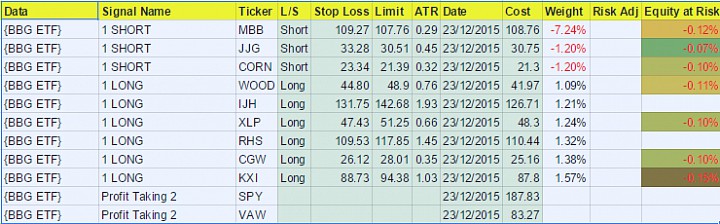

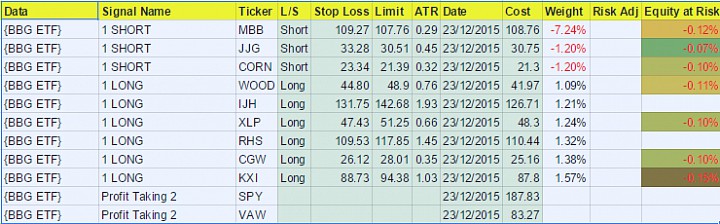

Alert table

The table contains the same information as charts, only in a more compact numerical form.

Types of Alert:

- Long Limit / Short Limit:

- Profit Taking: A swing has been recorded and the market is about to rebound/drop so time to take risk off the table. Exits are executed at market price: entry is a choice, exit is a necessity

- Trend reversal: Trend has changed from Bull to Bear and vice versa. Close open positions at market

- Stop Loss: remember the curse of Prometheus: liver may regrow, but Justin Bieber that is rough

- Weight: is derived from a fixed fractional position sizing method set at -0.10% (equity at risk method) for simplicity;s sake

That’s it, everyone is set. Happy trading. Two things, I trade the same signals that are shared on the website. Call it front-running or camaraderie. Rather than 5 pages of lawyerly bizantyne disclaimer, one sentence suffices: You are responsible for your own choices.

Conclusion

“The time to repair the roof is when the sun is shining”, JFK, modern mystery

Short-selling is a habit. It takes time, mistakes, patience to unlearn bad habits and form new beneficial neural pathways. The best time to do so is when urgency forces focus, but not critical enough to be a question of life and death.

The Fed has ended its life-support, which means more turbulence ahead. This is a good time to learn how to ride volatility with serene equanimity.