Regardless of the Asset Class, There Are Only Two Types of Strategies

Finance is one industry where there is no shortage of creativity. There is always a new strategy, investment vehicle, or asset class. This alphabet soup is confusing, particularly when it comes to assessing risk and reward across asset classes. Yet, there is a simple universal way to classify strategies. They fall into two buckets: either mean reversion or trend following. Simply said, the exit policy determines the win rate, which then shapes the return distribution.

Summary

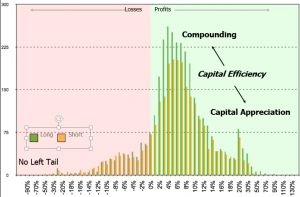

- A powerful visual representation of style/gain expectancy: Call to Action: our commitment is to help people become better traders. if YOU want to visualise your style, opt-in and we will send YOU a portfolio diagnostic tool for free

- Regardless of the asset class, there are only two types of strategies: mean reversion or trend following

- Each strategy type has a specific risk profile, which require different risk metrics. Common Sense Ratio recaptures risk for all strategy types (Read this, it is important)

- How to increase the win rate, gain expectancy and overall profitability depending on strategy type ?

I. The only two types of strategies: mean reversion or trend following

Over the years of patiently testing multiple algorithmic strategies, patterns in the return distribution repeated over and over. It eventually became apparent that strategies fall into two buckets: mean reversion or trend following. Attached are graphical representations of the gain expectancy of mean reversion and trend following strategies. The reason why the same patterns repeat themselves is simple: exit policy.

Market participants tend to treat exit as a single final event. Each trade is a binary event: either it is profitable or not. The accumulation shapes the return distribution. Hit ratio is then determined not by what we enter, but how we exit.

Charts below are return distributions for each strategy type. They are also visual representations of gain expectancy. One image speaks more than a thousand words. This representation changed my life. It permanently altered the way I perceive the markets. The game is about tilting gain expectancy: contain the left tail, moving the peak hit ratio to the right and elongating the right tail. This visual representation is a powerful tool. This is why we want to share it. We are committed to helping people build smarter trading habits. Sign-in to our newsletter (it’s free) and we will send you a portfolio diagnostic tool.

Mean reversion strategies compound small profits

Mean reversion strategies compound multiple small profits. They rely on the premise that extremes eventually revert to the mean. They aim ato arbitraging small market inefficiencies. They often have low volatility consistent performance. They perform well during established markets: bull, bear or sideways. They unfortunately perform poorly during regime changes. They also perform poorly during tail events. The key issue is to contain rare but devastating blow-ups.

- Moderate to high turnover

- High win rate: often above 50%. The shorter the duration, the higher the probability of success

- Consistent small average profits: trades are closed around the mean

- Low volatility consistent performance

- Potentially devastating left tail losses: make a little bit of money every day and lose a fortune in one day

- Long period of recovery after losses:

- Short Gamma: sell OTM options so as to collect pennies in front of a steam roller

- Pairs trading (non FX): bet on the convergence between two historically correlated securities

- Value investing: Buy low PBR stocks and “undervalued” assets

- Counter trend: sell short shooting stars and catch falling knives

Mean reversion strategies post modest but consistent profits. They cater to investors who would look for low volatility returns. Their challenge is the left tail, those infrequent big losses that will take a long time to recoup.

Trend following strategies rely on the capital appreciation of a few big winners. Whether they follow stories, fundamentals, earnings or price momentum, stock pickers are trend followers. They may fail to appreciate being called trend followers, but their P&L distribution tells a different story.

Trend followers kiss a lot of frogs: they have a low hit ratio, often between 30% and 45%. Performance is cyclical. Styles come in and fall out of favor. Volatility is elevated. Performance can be underwhelming for long periods of time. The key issue is to contain losses during drawdowns.

- Relatively low turnover

- Low win rate: 30 to 40%: see chart

- Big wins and lots of small losses: right tail on chart

- Relatively higher volatility

- Pronounced cyclicality: style comes in and goes out of favor

- CTA type systematic trend following,

- Momentum: earnings momentum, news-flow, price momentum

- GARP investing: growth at reasonable price

- Buy & hope

- Magnitude: never lose more than what investors are willing to tolerate

- Frequency: lull investors to sleep. Clients will trade performance for low volatility: big money is fixed income, not stocks

- Period of recovery: never test the patience of investors.

Mean reversion strategies have low volatility, consistent performance and high Sharpe ratio. On the surface, they are what investors look for. The problem is mean reverting strategies work well, until they don’t. Big losses are unpredictable. LTCM had a great Sharpe ratio, at least until October 15th, 1987… Risk is in the left tail. The best metric for mean reverting strategies is therefore: tail ratio. Tail ratio measures what happens at the ends of both tails:

The question boils down to: is it possible to combine the benefits of both strategy types without having the drawbacks of either one ? How can we generate a return distribution that would look like the one on the chart ? (*)

The question boils down to: is it possible to combine the benefits of both strategy types without having the drawbacks of either one ? How can we generate a return distribution that would look like the one on the chart ? (*)- No left tail: small losses like a trend following strategy

- Long right tail: big wins like a trend following strategy

- High win rate: above 50% win rate like a mean reversion strategy

This type of strategy combines both short term compounding with long-term capital appreciation.

- Set a stop loss (more on this in an upcoming article)

- When the trade means reverts, close half the position

- Set a trailing stop loss (not based on valuation) and close the trade once the stop loss is penetrated

- Calculate your average contribution, divide it by 2

- Reduce by half every losing position below – half average contribution

- re-allocate the proceeds to winners

- Market regime: bear markets have several distinctive phases, with a measurable market signature

- You will never read an analyst report the same way again. You will learn to read emotions through language and back it up with numbers

- You will be better equipped to bottom fish for stocks

Definitely believe that which you stated. Your favorite justification appeared

to be on the internet the simplest thing to be aware of.

I say to you, I definitely get irked while people think about worries that they just don’t know about.

You managed to hit the nail upon the top and also defined out the whole thing without having side

effect , people could take a signal. Will probably

be back to get more. Thanks

Very good article. I absolutely appreciate this site.

Stick with it!

Thank You very much

Write more, thats all We have to say. Literally, it seems like as if you trusted the video to make your

point. You obviously understand what youre discussing, why waste your intelligence on just posting videos to

the blog when you could be giving us something enlightening to learn?

Hi to all, the contents existing at this web site are really remarkable for people knowledge, well, keep

up the good work fellows.