Our Research

The world does not need yet another market commentator. Our tools are designed to help investors along their investment journey

- Signals: trend reversal signals (Bull/Bear) on equity indices, Forex and government bonds

- Trading systems: simple steps from concept, back tests to auto-trade

- Money management: bet sizing algorithms, money/risk management tools

- Psychology: research and practical tools on habit formation

- Topics: discussions on the industry, trends

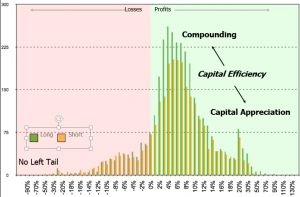

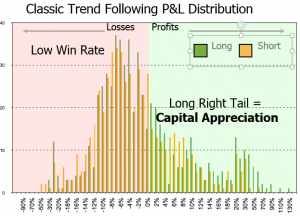

The game of two halves: an elegant two-step process designed to cut losers, run winners, while maintaining conviction

In every hospital around the world, there is an unwritten rule: surgeons should not operate on their own children. There is no such thing as professional detachment when it comes to your own child. In the investment realm however, market participants are consistently asked to defend their convictions, but also expected to be surgical about their losers. How can someone maintain enough attachment to weather rough times, but stay detached enough to surgically cut when necessary ?

- Either reduce the number of frogs: easier said than done, particularly when strategies stop working at some point through the cycle

- or, their impact is reduced: reducing drag will mechanically improve profitability

- Divide all positions between contributors and detractors, calculate average contribution: first half

- Reduce weight by half (1/2) for all detractors below -1/2*Average contribution: second half

- If Babylon meets a tragically eponymous fate : it would have to drop another -15%, just to reach minus average contribution, or -0.5%. At this point, it will be either it is a screaming Buy or a dog. Either way, it will be an easier decision to make

- If Babylon rises: then unrealised profits will compensate for realised losses. One rule of thumb in order to maintain a positive trading edge, do not add to the position until it crosses previous entry price

- Trading edge mechanically improves: this is a simple elegant formulation of the first mantra: “cuts your losers and ride your winners”

- Good stewardship: managers are often torn between defending their convictions and dealing with problems. If they cut too frequently, they are perceived as lacking conviction, which negatively impacts investors confidence. By selling a portion of the position, they show peers and investors that they both maintain their conviction and deal with problems

- Process versus outcome neural pathways re-wiring: funds reach capacity not when they are too big in size, but when inertia sets in. Dealing with losers forces managers into action. This accomplishes three things:

- Managers become dispassionate with their problem children: since dealing with them improves stewardship, the stigma of taking a loss disappears. The game is simple enough to be executed even in the darkest

- Increased fluidity: since proceeds are re-invested, managers have a direct incentive to look for fresh ideas, or to their existing ones

- Process versus outcome mindset: believing that being right about a stock is a matter of profitability is an outcome process. When ideas are profitable, ego gets validation. When (not if) they are unprofitable, ego feels under attack. This invariably leads to defensive, unprofitable and often destructive behaviors. Dealing with losers in an orderly fashion changes focus from outcome to process. Being right is no longer about the outcome but about doing the right thing.

Daily #ETF signals

Thought of the day: “Do not go where the path may lead, go instead where there is no path and leave a trail”, Ralph waldo Emerson, Happy Birthday

- Great traders are not smarter, they have smarter trading habits

- If You are interested in short-selling, trading systems, position sizing, trading psychology, visit us at: www.alphasecurecapital.com

- WIP Bearish Strength

- AAXJ Bullish Weakness

- Bullish weakness: Longer-term trend is bullish. There has been some temporary weakness, but the uptrend is likely to resume

- Bearish strength: Longer-term trend is bearish. There has been some temporary rally, but the downtrend is likely to resume

- Volatility Channels (Horizontal dotted lines) : Markets often retest swings. This is a volatility buffer to allow wiggle room.

- Volatility Channel: Think of the other side of a volatility channel of the distance it would take to close half the position to break even if the remainder was to hit the stop loss

- #n%: Think of it as a rudimentary equity at risk position sizing. It is 1% divided by the distance from the day the swing is recorded to the volatility channel

- Disclaimer: this is neither a solicitation, nor an investment advice

Weekly #Forex signals

Thought of the day: “Do not go where the path may lead, go instead where there is no path and leave a trail”, Ralph waldo Emerson, Happy Birthday

- Great traders are not smarter, they have smarter trading habits

- If You are interested in short-selling, trading systems, position sizing, trading psychology, visit us at: www.alphasecurecapital.com

- USDNZD Weekly Bullish Weakness

- Bullish weakness: Longer-term trend is bullish. There has been some temporary weakness, but the uptrend is likely to resume

- Bearish strength: Longer-term trend is bearish. There has been some temporary rally, but the downtrend is likely to resume

- Volatility Channels (Horizontal dotted lines) : Markets often retest swings. This is a volatility buffer to allow wiggle room.

- Volatility Channel: Think of the other side of a volatility channel of the distance it would take to close half the position to break even if the remainder was to hit the stop loss

- #n%: Think of it as a rudimentary equity at risk position sizing. It is 1% divided by the distance from the day the swing is recorded to the volatility channel

- Disclaimer: this is neither a solicitation, nor an investment advice