Our Research

The world does not need yet another market commentator. Our tools are designed to help investors along their investment journey

- Signals: trend reversal signals (Bull/Bear) on equity indices, Forex and government bonds

- Trading systems: simple steps from concept, back tests to auto-trade

- Money management: bet sizing algorithms, money/risk management tools

- Psychology: research and practical tools on habit formation

- Topics: discussions on the industry, trends

Quora.com: What-do-the-fund-managers-that-consistently-beat-the-market-do-differently-when-picking-stocks-than-those-who-cant-beat-the-market

Portfolio Manager serenity prayer

Risk and trading edges are not stories, they are numbers

- Win%: the tighter the stop loss, the lower the win rate

- Loss% (1 -Win%): and vice versa from above

- Avg Loss %: stop losses cap your losses. BTW

- You can’t buy if You are fully invested

- Position sizing: anchor your stop loss and limit prices for position size

90% of trading is mental, the other 50% is good math

Complexity is a form of laziness

Grandmother’s advice on advises

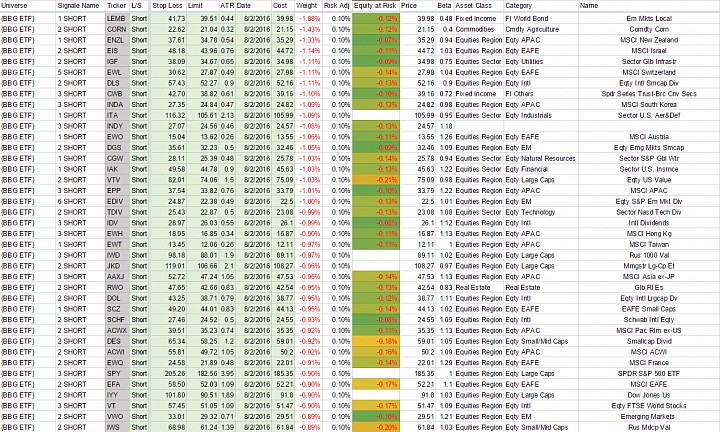

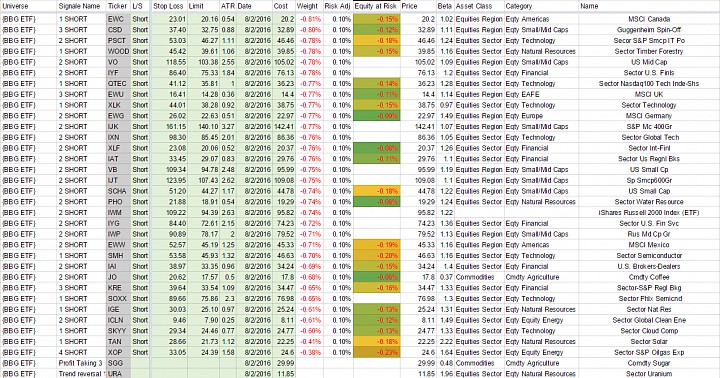

Round 2: synchronous short selling signals across multiple asset classes

1. Trading journal

2. Tip of the day: Triage, kick out the free loaders and never trade laggards

1. Trading journal: Round 2, time to short again and don’t complain there aren’t enough short ideas

This is the big day, time to get back in the ring. Short squeeze came and went. Now, stocks are rolling over again. This is quite an unusual to do so though. Roll-over usually happen over the course of a week. This time, it’s different (just love to say that to confuse people).Roll over happens across asset classes on the same day. In fact, there were so many they had to be split in two files. It took more than an hour and almost half a bottle of Prosecco to process them. So, don’t complain there aren’t enough short selling ideas.

So, “is it the right time to dip our toes in the water ?” When everyone is buying, short selling seems like a bad idea. By the same token, when everyone around the world, across asset classes is selling, does it sound like a good idea to go out and buy ?

If You want details on any signal, send a mail or a comment and i will post it with comments.

All signals are ranked by size assuming a 0.10% risk per trade. I placed a whole bunch of orders. The priority algo was as follows:

- Free up some space and kick out free loaders: see Tip of the day

- Top-up of existing positions: SPY, EWL, EWH, EPP, PHO, VWO. Ignore EWA, IDV and TDIV already fully loaded or expensive borrow

- Enter qualified trend reversals: we have designed a neat trend reversal qualification test some time ago. This is as early and as safe as a trend reversal can be detected. So, anchor positions with minimum risk per trade very near the top

- Enter trending shorts by size and lot numbers: the bigger the size and the higher the number of lots the better. High lot number means easier partial exit

Tip of the day:

Triage:

- Make space, get rid of stale positions: multiple simultaneous positions means something happened in the markets. So, the first thing to do is to get rid of the positions that did not react. Those that do not react are likely to hurt when the market moves the other way. For example, during this sell-off, some positions held their ground. Two of them even went up. Fine, OUT now. Yeah but the thesis, the long term prospect, blah blah blah. Sure, when ready to cooperate, we will talk about it, but for now OUT. This frees out some resources to more promising ideas

- Weight ranking: position sizing algo is fixed fraction position sizing of equity at risk -0.10%. So, for the same risk budget, the bigger the position size, the lower the volatility. Yeah, but i like the thesis on bio stocks. Great, they are too volatile still, so wait until they are ready for a serious relationship

Free Loaders:

Managers often fail to meet their objectives not because of spectacular blow-ups, but because of the drag of poor performing stocks. So, relentlessly kick out stocks that do not react or perform poorly. Here is a simple powerful way to reframe the situation

If You owned a building, would You allow tenants to stay rent free ? No, You expect them to pay their rent. Apply the same discipline to stocks and performance will mechanically improve. Here is a simple elegant “how to” article

http://alphasecurecapital.com/the-game-of-two-halves-an-eleg…

Never trade laggards

Brokers and fund managers have this constant fear of missing the boat (fear of missing out or FOMO). So, they have come out with this brilliant idea to round up thematic stocks and identify laggards. The basic thought is “This is the next…”. IBM is not the next Apple, Squarespace is not the next Facebook. Laggards are just left overs

The best remedy is to think that the boat You just missed is not an ocean liner but a Vaporetto. There will be another one shortly. The market will give You another chance

Trading Journal 20160203

Trading Journal 20160203

1. Trading Journal

2. Tip of the day

Trading Journal

As explained in a previous post, Shorts entered after a squeeze offer better visibility and have higher probability of success. So, the alert pad came back quite full. Most of the signals are frequent flyers on the short side.

Shorts are like a glasses of wine, they tend to be depleted, so they require regular top-ups. Let:s not complicate things here.

Here is how to read the above table

- Stop Loss: it has a dual function, one obviously to put a quick end to a bad trade for now. The second function of a stop loss is to calculate a position size. Those are isometric staircase stop loss using a multiple of ATR 2.5 or 2.6

- Limit: Entry is a choice, exit is a necessity. This has been severely back-tested and reinforced in real life trading: this strategy works best over time if we do not chase stocks. Stop Loss and Limit are used to calculate position size

- ATR: Average True Range 20 days, simple average.

- Weight: suggested position size. This is a Fixed Fractional Position Sizing method or equity at risk that assumes -0.10% risk per trade. This is a clean simple multiplier

- Risk Adjustment: this is the -0.10% factor

- Equity at risk: position sizies are rounded to the nearest lot and this gives residual equity at risk

- Ranking order: the bigger the better. For a same risk budget, the trade suggesting the largest size comes first. There is no “qualitative/fundamental” assessment here. Size is a primarily a reflection of the volatility signature

For the record, I have placed orders on some of those ETFs. I am not suggesting You should buy/sell/short sell or buy to cover any of those signals.

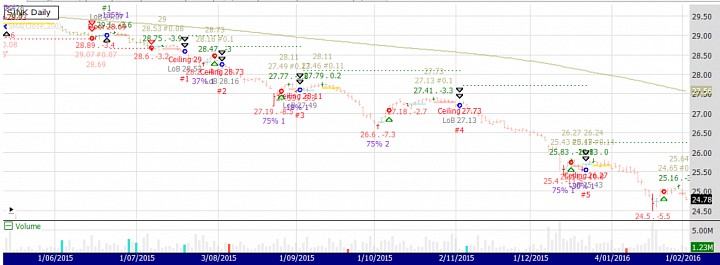

As You can see, the numbers at the right side of the charts are the same as the ones on the table. In fact, I go through every chart and write those numbers.

SJNK is another junk bond ETF. It has low volatility and clean trend. Those are rare and nice shorts: bearish calm

On the Long side, the information is below the swing point. Interestingly enough, the algorithm flagged a partial exit shortly before this re-entry. Re-entries are possible only after a partial exit has been performed.You

The logic is simple: take risk off the table before adding some. Adding to a position with open risk compounds risk. It works until it does not

Tip of the day

Whatever asset class and time frame, we all trade the same thing: risk. So, the first order of business after entry is to reduce risk.