Our Research

The world does not need yet another market commentator. Our tools are designed to help investors along their investment journey

- Signals: trend reversal signals (Bull/Bear) on equity indices, Forex and government bonds

- Trading systems: simple steps from concept, back tests to auto-trade

- Money management: bet sizing algorithms, money/risk management tools

- Psychology: research and practical tools on habit formation

- Topics: discussions on the industry, trends

Can the Quant Meltdown of August 2007 repeat again in the future?

Can the Quant Meltdown of August 2007 repeat again in the future? by Laurent Bernut

Answer by Laurent Bernut:

This is an excerpt from the book i am writing on Short selling

Start with the Shorts in mind

In August 2007, cross sectional volatility took all markets around the world by surprise. Indices did not move much in aggregate, but constituents jumped and crashed 2-3% across the board for two days. Then, rumours of quants funds, such as Goldman Sach’s flagship market neutral unwinding, started to spread. This was the beginning of the end for quantitative market neutral funds. Their short books were the culprits.

Leverage

Quants had built those models where they had an arbitrage Long good / Short poor quality stocks. Since they were market neutral, the cash proceeds from short selling could be used to leverage up almost ad infinitum. Some funds were levered up 7 times. Leverage was used to magnify otherwise underwhelming returns.

Quality was working well on the Long side. All they had to do was match exposure on the short side. They had to continue short selling in order to match the natural expanding Long side. It all worked well until volume started to dry up during the summer months.Liquidity on the short side and chain reaction

They eventually realised it would take them weeks to unwind their short positions. So, they proceeded to pare positions down to manageable liquidity. Since everyone with roughly the same models came to the same realisation around the same time, it triggered a chain that culminated into a messy cross sectional market.Not so safe after all

Back in those days, market neutral funds were marketed as safe investment vehicles: equity returns with fixed income volatility. When some funds started posting -4 to -8% returns during seemingly quiet markets, investors panicked. Soon enough, redemptions started to come through.

Those redemptions forced managers to close positions, thereby adding more volatility. Prime brokers asked for larger collateral as Value At Risk (VAR) increased, thereby forcing funds to reduce leverage. With reduced leverage, increased volatility and piling redemptions, it was game over for market neutral funds.Morale of the story

It all started with one simple mistake: in their minds, the short side just happened to be some byproduct of the Long side.

Morale of the story: whatever has the power to kill a business is not a sideshow. The short side may command higher fees and reduce risk, but when neglected it has the power to bring a business down.This will happen again in the future as long as market participants do not take the dynamics of the short side into acount

Can the Quant Meltdown of August 2007 repeat again in the future?

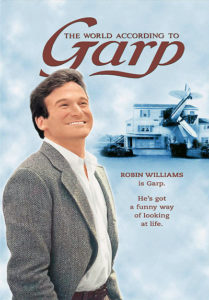

The short-selling world according to DARP

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.

then it should work. It should work but it does not. The Short side is still Terra Incognita, a vast continent populated with savage speculators. It obeys its own rules, its own dynamics. Newcomers to the world of short selling tend to be either too early or too late. Profitable shorts are at least as plentiful as long ideas. Market participants just don’t look for the right clues.- buy the stock

- graciously offer the borrow for free

- and send a box of chocolate to whomever wants to short. Chocolate is a good therapy for smoothing the rough short squeezes ahead

- Divorce from reality: Structural shorts are like market gurus: they are a dime a dozen. Profitable structural shorts are like market wizards, good luck finding one. Borrow is expensive and long holders have left the building a long time ago

- Abdication of responsibility: when they say they want structural shorts, what they mean is they do not want to be bothered with the short side anymore. They want to find something that they can throw in the short book and “forget about it”. This is an implicit acknowledgement of failure. They are happy to collect fees, but reluctant to do the work. There is obviously no hedge, no downside protection, no free lunch and eventually no happy ending.

At this stage, market participants resort to futures. They realise their vulnerability both versus the markets and versus their investors. The problem is futures do not offer much protection when markets tank. Besides, investors are understandably reluctant to pay exorbitant fees for something they can do themselves. They are willing to pay as much

Between the time when Valeant was puffed up to “unsustainable valuations”, and the first analyst to throw the towel with a “Sell” rating, share price actually did go down by roughly -80%. There was no “beam me down Scottie”, exchange between share price and the deck of the Enterprise. Share price did go down over time, but market participants were institutionally blind to it.

#Quora: How can Renaissance Technologies make so much money from financial markets by hiring scientists/mathematicians with no domain knowledge o…

How can Renaissance Technologies make so much money from financial markets by hiring scientists/m… by Laurent Bernut

Answer by Laurent Bernut:

I have never worked at Renaissance, so please take my answer with a grain of salt, but here is a first hand story that could shed some light.

On June 22nd in NYC, my colleague, who is also ex-US Department of Defense consultant and myself, met with one of the foremost US experts on sonar detection (good luck finding him on Facebook, LinkedIn). He is a physicist with multiple PHDs, geeky funny. His expertise is signal processing. He is the real “Hunt for Red October”.

It was one of the most refreshing experiences ever. He explained his world. I explained mine. Cotes de Provence Rose, beer and wild berry Zinfandel helping, we tumbled down the rabbit hole talking even about epistemology, the philosophy behind math.

His world, signal processing, bears uncanny resemblances with ours. We explored Bayesian probabilistic determinism, which models (Gauss, Poisson etc) to apply to distributions, the cost of false positives (think trading edge), arbitrage between time and action with sparse data (confirmation). We spoke the same language. We were talking real problems: how do distinguish signal from the noise ? How fast ? What is the cost of being wrong ? What is the cost of being right ? Which statistical law applies to randomness ?

We entered a massive time distortion. We started around 2 pm and a couple of bottles down the road, but then after what seemed like 5 minutes, we were hungry. It was 10 pm. We could have gone on forever (*)

Compare this with glorified journalists, otherwise referred to as fundamental analysts.

- “This is fairly valued”… life is unfair darling, so do you really think markets are fair ?

- “On a sum of the parts valuation”… Frank N. Stein zombie valuation

- “Fundamentals are strong”… Make fundamentals great again…

- “Long term story is still intact”… Some HF reality TV celeb says that about Valeant by the way…

- “On a DCF basis, our target price is +10% above current market valuation” … stop tinkering the terminal value to rationalise your subjective views

- “i think there is 80% chance that” … bad arithmetic meets emotional roller coaster

- “top quality management” … was also said about Enron, Bear Sterns, Kodak, GM, Chrysler, Valeant

Too much B/S bingo, too much theory,

Bottom line: “In theory, theory and practice are the same. In practice, they are not”. Yogi Berra, Yankee philosopher

Physicists approach the markets as a statistical problem. This is practical.

MBAs have too much untested theories in their head. It is costly and time consuming to unlearn all that junk.

(*) There is no way i could ever afford someone of that caliber; he charges something the size of Liberia’s national deficit per hour. But, he wants to send his granddaughter to Mars and he thinks our algo could be the right fuel, so we invited him to have fun with us. Maybe good guys do not always finish last…