Our Research

The world does not need yet another market commentator. Our tools are designed to help investors along their investment journey

- Signals: trend reversal signals (Bull/Bear) on equity indices, Forex and government bonds

- Trading systems: simple steps from concept, back tests to auto-trade

- Money management: bet sizing algorithms, money/risk management tools

- Psychology: research and practical tools on habit formation

- Topics: discussions on the industry, trends

10 myths about short selling

Myth 1: short sellers destroy your pension

- Long Only active managers who have a sustained long term track record of hurting your pension

- Short sellers who will make money when the going gets rough.

Isn’t it fair to say that short sellers should be your pension’s new BFF ?

Myth 2: Short sellers destroy companies

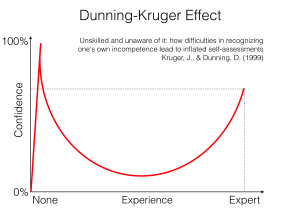

Kruger (*) dark side of the force. Senior managements at companies like Apple (round 1), Lehman Brothers, Kodak, Enron, GM, Volkswagen are perfectly arrogant, incompetent and stubborn enough to run their venerable institutions into the ground themselves. Short sellers do not compound sub-optimal executive decisions, otherwise referred to as stupid mistakes. They see something going down and just hop on for the ride.

Kruger (*) dark side of the force. Senior managements at companies like Apple (round 1), Lehman Brothers, Kodak, Enron, GM, Volkswagen are perfectly arrogant, incompetent and stubborn enough to run their venerable institutions into the ground themselves. Short sellers do not compound sub-optimal executive decisions, otherwise referred to as stupid mistakes. They see something going down and just hop on for the ride.Myth 3: Short sellers manipulate markets

Myth 4: Short sellers want the demise of the economy

Myth 5: Short sellers destroy value

Myth 6: short sellers are responsible for the collapse of share price

Myth 7: Short sellers accentuate market volatility

Myth 8: short selling increases risk

Myth 9: I don’t need to sell short during bull markets. I will just put on some shorts when the market turns bearish

Myth 10: Short selling has infinite downside potential

- always place a stop-loss: if You don’t have an exit plan, then You will not like what the market has in store for You

- control risk through position sizing: the most important question about fund management is: would You rather earn less than You could or lose a lot more than You should ?

- stay away from crowded shorts like penny stocks: risk is a binary event: either bankruptcy or recovery.

[Comments, feedback are uppermost welcome. This is a collaborative effort]

@Quora: If most people lose in the stock market or gambling, then would I make money by doing the opposite of the average person?

My answer to If most people lose in the stock market or gambling, then would I make money by doing the opposite of …

Answer by Laurent Bernut:

Statistically speaking, You would be exactly in the same position as the person You go against

There is something called the serenity prayer. Here is a simple adaptation:

Allow me to go with the flow when it is in the right direction

Allow me to stand against the crowd when they are running in the wrong direction

Give the wisdom to know which is whichAn ethousiastic reader commented on an answer I provided about predictive technical analysis, saying that the win rate of Fibonacci and iterations of it such as de Mark have a win rate of around 40%. He said I was an idiot (true) but more importantly if it was the case, people would do the opposite and win (false). While I have rarely been accused of being intelligent, probabilities still do not work like that.

There are three types:

Clear wins

Clear miss

Near miss/win

The third category is between 10 to 30%, 10 for simple (elegant) systems, 30 for simplistic (naive) stuff. So, doing just the opposite of what everyone else does will not make You a hero. Sell Apple short because everyone else is buying will achieve one thing only: provide liquidity for other buyers, thank you very much

How to tilt your trading edge

This is an important point for people who develop systematic automated strategies: improving the trading edge comes from reducing false positives, or moving near wins (small losses) into near misses territory (small wins). The compounding effect of tilting the win rate and the average win has dramatic impact on the overall gain expectancy.

For example, in our strategy, we have introduced a lag in the stop loss, called “French Stop Loss”, because it is fashionably late “bien sur”. This gives additional wiggle rooms to each trade. They can mature and are rarely stopped out. Not all of them succeed however. Some are closed because trend reverts. This is far less costly than stop loss though as trend reversals occur around break even. The number of stop losses has come down by almost 3/4 and now trades are closed around the break even point. This has considerably reduced erosion and has allowed us to increase the number of pairs traded from 12 to 36.

@Quora: How do i improve the sharpe ratio of my trading strategy?

My answer to How do i improve the sharpe ratio of my trading strategy?

Answer by Laurent Bernut:

Reverse engineering Sharpe ratio is the trademark of some very large shops, with a large pension fund clientele… Like diet, it is simple in theory but not easy in practice.

How to boost Your Sharpe

The basic idea is to generate consistent returns however puny and then magnify them through leverage. Here is how it is done step by step:

- Collapse volatility: only one way to do it, collapse net exposure (Long -Short market value) to a band +/-10%. That is tantamount to market neutral. Few strategies can achieve this.

- The most common way is pairs-trading. This has built-in market neutrality, but some unpleasant side effects such underwhelming returns and left tail risk

- Another way to achieve low net exposure is to run series not on absolute but prices relative to the benchmark. The long book outperforms while the short book underperforms. It then becomes a matter of controlling net exposure. This reduces the correlation risk

- Generate low volatility consistent returns: returns can be nanoscopic, it does not matter, as long as they are positive. Consistency matters more than quantity because the denominator is a function of volatility of returns , i-e consistency

- Leverage up: if your net exposure is +/-10% and your returns are consistently positive, then You happen to have a low

apparent risk profile. So, your prime broker will be willing to extend your leverage. Now, if you clock +0.20% at 200% gross exposure and your PB accepts to lend 4 times, you could wake up with consistent +0.80% per month. times 12 and before You know You will be on the cover of magazines

Limitations:

- Very important: Read this Sharpe ratio: the right mathematical answer to the wrong question by Laurent Bernut on Posts

- Pairs trading has a nasty side-effect that few people are aware of. It is essentially a mean reverting strategy. It works very well until it blows-up. It does not need to blow up “a la LTCM”. It takes a loss of 3-4% in one month and a full year to recover

- Most market participants do not understand Sharpe ratio. They assimilate volatility and risk. Volatility is an expression of uncertainty. Risky strategies are not necessarily volatile, they have open ended risk like short Gamma strategies

Conclusion

Sharpe ratio is part of the Modern portfolio theory package. This dates back to one of the major crimes against humanity of the otherwise barbaric XXth century: the year the US army drafted Elvis. Doctors prescribed pregnant to smoke cigarettes to calm anxiety back then… Maybe it is time we upgraded our repertoire