Trading Journal 2016/01/20

This is a test. If You find value in this trading journal, please let us know. If there are topics You would like to see covered, please comment and suggest. This journal exists only because You find it useful. So, help us create something You need.

1. No signals today

2. Trading activity Last night. Risk at this stage of a sell-off

3. General considerations:

- The vaporetto has left, there will be one coming soon: don’t short now, wait for the squeeze

- TIP of the day: counter-interintuitive truths about crowded shorts and performance during sell-offs (must read for novice short sellers)

- Position for the squeeze and beyond

Trading

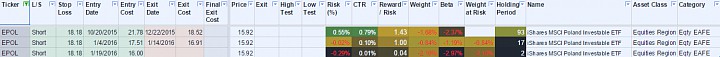

Last night there was another Short EPOL, the ETF for Poland.

Here is how to read the chart:

Direction: Short. Comment: Trend is clearly fast bearish with low volatility. That trade has packed a lot of octane (reward to risk / holding period)

Stop Loss: 18.18

Target price: 15.97

Max Risk Per Trade suggested: -0.39% ( per convexity algo, not the standard -0.10% that will give readers a clean multiple). That is 95% of risk per trade

Trading Journal

RIsk: I elected to allocate -0.29% of risk. Risk is a number, not a dissertation. These are the reasons:

Pros:

- This is the third tranche. There is embedded risk free P&L of 0.53% that gives some cushion.

- More importantly, the lot size is such that only a small move is necessary to be able to cover a large portion and subsequently break even. It needs to generate 0.08% in order to reach break even level

- Current position before trade is getting small. It needs to be replenished

Cons:

- Trend is maturing. Borrow cost has increased accordingly. This is the third tranche in less than 4 months. Time for a break maybe ?

- Correlation increasing across asset classes, synchronous shorting is dangerous, so tone down the risk, take off -0.05%

- Rebound was small in duration and magnitude. It may be a false positive. In those fast trend it is either mid section, either before the rebound, take off -0.05%

Verdict: take the trade, but because of synchronous sell-off, reduce risk

3. General market considerations

If You haven’t shorted yet, it is too late. Vaporetto has left. Do not jump onboard now, You’ ll drown and feel stupid. Be patient, keep your powder dry.

Time is better spent observing the markets and observing your thoughts. Journal your thoughts. Observe the monkey on your shoulder.

Homework: this is a great time to get ready for the next campaign: (I have a system so I don’t need to do this anymore), but here is what I would look for: the weakest stocks that are not heavily shorted. Those are the stocks that Long holders sell.

Now is the time to think about the upcoming squeeze and beyond

The probability of a squeeze increases day by day. It is about time for a bit of mouth flapping. They call it reassuring the markets these days.

When they turned off free monetary booze, they expected a bit of weening turbulence, some whining, so no big deal so far.

Now that the vaporetto has left, let’s wait. When the squeeze comes, cover positions (half if You don’t have a system), or break even level if You use a similar equation as mine.

There is no need to cover it all. Markets have turned bearish, so the idea is to cover a portion, ride the squeeze and then slap another tranche.

Roadmap

When the squeeze is over, I will gross-up my leverage. At 127% Gross, -62% net, -22% net at risk today, I am under-participating. The idea was to start the year slow, build some performance cushion and gross up gradually. Bad idea to start sprinting at the beginning of a marathon.

So, when the squeeze comes, net at risk should drop to sub -10%. After the squeeze, gross up so that the net at risk be around -50/60%. This should be a gross of roughly 180-200% .

Now, life is usually what happens when You had other plans.

TIP of the Day: counterintuitive truth about short selling

You will usually find an inverse correlation with borrow utilisation level and performance in sell-offs. In other words, stuff that is heavily shorted all year round holds its ground during sell-off. Money is not made shorting the same stocks everyone shorts: Elvis has already left the building.

Money is made spotting the stocks that are not heavily shorted but underperform the markets. It makes counterintuitve sense: the market participants selling are Long holders selling their positions. Information has not traveled yet

These are the guys we will stalk, these are the guys whose coat we will tail. They are going through a process of grief: Denial, Anger, Bargaining, depression and acceptance. I quantified the process a few years ago. In fact, it was my first public speaking opportunity.

More about this and the Kubler Ross grief model applied to the markets on my website at www.alphasecurecapital.com . Please subscribe, It keeps me motivated. It is free and has resources for committed traders.

Conversely, make a note of the heavily shorted stuff that outperforms or holds its ground. This is squeeze box material where all the structural short sellers go impale themselves.

Nice article. Sums up my thinking and views well. I have not been able to quantify it all as yet.

Thanks for the idea on trading short squeezes. I can compare high shorted stocks vs index and look for the out performance. I use short dated options to trades these as they give VERY good bang for buck with limited risk.

Can you point me to the link to the grief model?

Good morning James

Thank You for your comments and encouragements. I meant to post something yesterday, but I was sucked down the rabbit hole looking for a bug in the code. Next thing I know, this bottle of Sicilian indigenous grape Perricone is half empty and sun rises on Palermo

The signal was Long IAU, the ETF for gold. Some market participants insist on finding stuff to buy amidst bear markets. This is like shopping for a bikini in the middle of winter. It is possible but it is risky. IAU is a form of refuge. I placed an order, wanted to write something quick, but got pulled in. Apparently I got filled so I will talk about it later

http://alphasecurecapital.com/the-view-from-the-short-side-how-we-process-emotions-and-the-market-signature-of-the-5-stages-of-grief/

This is the note. It was my first public speaking opportunity in front of a full house of Long Only smart people at Fidelity. They really liked the language and still refer to it years after. More importantly, it will give You some pointers. You will probably take articles with a grain of salt.