Our Research

The world does not need yet another market commentator. Our tools are designed to help investors along their investment journey

- Signals: trend reversal signals (Bull/Bear) on equity indices, Forex and government bonds

- Trading systems: simple steps from concept, back tests to auto-trade

- Money management: bet sizing algorithms, money/risk management tools

- Psychology: research and practical tools on habit formation

- Topics: discussions on the industry, trends

Daily #Stock_Markets 2015 – 04 – 01

- Bullish weakness: Longer-term trend is bullish. There has been some temporary weakness, but the uptrend is likely to resume

- Bearish strength: Longer-term trend is bearish. There has been some temporary rally, but the downtrend is likely to resume

- Volatility Channels (Horizontal dotted lines) : 1 Average True Range (ATR) away from the swing

- #X%: this is the distance from the opposite Volatility Channel. For example, in a bullish trend, it would be the distance from the swing low. It can be inetrpreted as a rudimentary 1% equity at risk bet sizing

- Disclaimer: this is neither a solicitation, nor an investment advice

- Great traders are not smarter, they have smarter trading habits

Visit our website at www.alphasecurecapital.com Great traders are not smarter, they have smarter trading habits

Thought of the day: “”Education is our passport to the future, for tomorrow belongs to the people who prepare for it today”, Malcolm X

RTSSTD Bullish Weakness

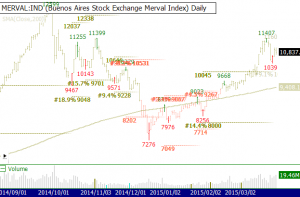

MERVAL Bullish Weakness

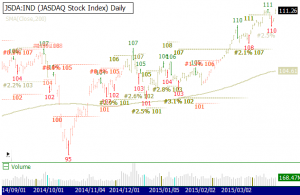

Jasdaq (Japan) Bullish Weakness

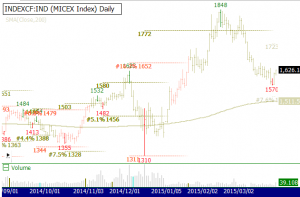

INDEXCF Bullish Weakness

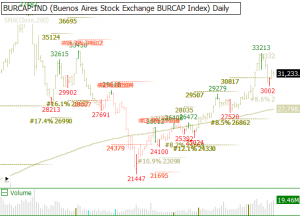

BURCAP Bullish Weakness

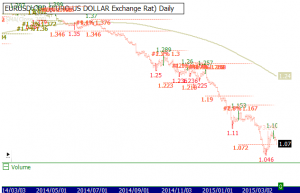

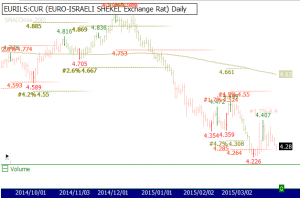

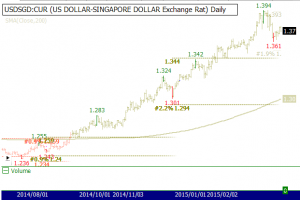

Daily #Forex signals 2015 – 04 – 01

- Bullish weakness: Longer-term trend is bullish. There has been some temporary weakness, but the uptrend is likely to resume

- Bearish strength: Longer-term trend is bearish. There has been some temporary rally, but the downtrend is likely to resume

- Volatility Channels (Horizontal dotted lines) : 1 Average True Range (ATR) away from the swing

- #X%: this is the distance from the opposite Volatility Channel. For example, in a bullish trend, it would be the distance from the swing low. It can be inetrpreted as a rudimentary 1% equity at risk bet sizing

- Disclaimer: this is neither a solicitation, nor an investment advice

- Great traders are not smarter, they have smarter trading habits

Visit our website at www.alphasecurecapital.com Great traders are not smarter, they have smarter trading habits

Thought of the day: “”Education is our passport to the future, for tomorrow belongs to the people who prepare for it today”, Malcolm X

EURUSD Bearish Strength

EURILS Beraish Weakness

USDSGD Bullish Weakness

Daily #ETF Signals 2015 – 03 – 31

- Bullish weakness: Longer-term trend is bullish. There has been some temporary weakness, but the uptrend is likely to resume

- Bearish strength: Longer-term trend is bearish. There has been some temporary rally, but the downtrend is likely to resume

- Volatility Channels (Horizontal dotted lines) : 1 Average True Range (ATR) away from the swing

- #X%: this is the distance from the opposite Volatility Channel. For example, in a bullish trend, it would be the distance from the swing low. It can be inetrpreted as a rudimentary 1% equity at risk bet sizing

- Disclaimer: this is neither a solicitation, nor an investment advice

- Traders are not smarter, They have smarter trading habits

Visit our Website at : www.alphasecurecapital.com

Thought of the day:

“Suffering is necessary until You realize it is not necessary”, Eckhart Tolle

GLD Bearish Strength 2015-03-31.png

DEM Bullish Strength 2015-03-31.png

EWG Bullish Weakness 2015-03-31.png

EWI Bullish Weakness 2015-03-31.png

EWJ Bullish Weakness 2015-03-31.png

EZU Bullish Weakness 2015-03-31.png

FEZ Bullish WEakness 2015-03-31.png

IJR Bullish Weakness 2015-03-31.png

VEU Bullish Weakness 2015-03-31.png

XLB Bullish Weakness 2015-03-31.png

XLF Bullish Weakness 2015-03-31.png

XLV Bullish Weakness 2015-03-31.png

XRT Bullish Weakness 2015-03-31.png

http://monosnap.com/list/551a532f0077917a4fce92e5

AGQ iShares Bearish Strength 2015-03-31.png