@Quora: In trading, how can I stop getting emotional?

Answer by Laurent Bernut: @Quora: In trading, how can I stop getting emotional?

Excellent answer from @Nate Anderson. Viktor Frankl (Man’s search for a meaning) survived both Auschwitz and Dachau. One of his most profound lessons was that: “between stimulus and response, there is a space called freedom”. You cannot control what is happening to You, but You can control your response.The paradox of systematic traders and psychology

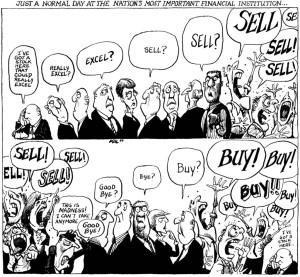

Every systematic trader who writes about building trading system devotes a lengthy chapter on psychology. Meanwhile fundamentalist hardly ever talk about psychology. You would think that mechanical traders would care less about psychology and people who rely on their judgement talk more about it.My theory is that systematic traders experienced mentally devastating losses which prompted them to develop systems so as to remove emotions. Along the way, they managed to quantify their systems and realised that after all is said and done: 90% of trading is mental, the other half is good maths.Bottom line: Your emotional hijack means You do not have system yetThe counter-intuitive trick about system development

Most people who develop systems fail to execute. There are two reasons: they focus on the wrong thing and they don’t have faith in their system.Wrong focus: the only soldiers who do not have exit strategy are kamikaze

People focus exclusively on entry and consider exits as an after thought. They have it completely backward. Entry is a choice, exit is a necessity. Emotions kick in once a position is in the portfolio, not before.Real life example: Long IAU strike 11 April 2016 options at 0.20 on entry date. Actually, I had my eye on the 12 strike but a fat fingered Viognier Zibibbo called Abraxas (how can You not surrender to that deadly combination ?) got in the way of trading. I felt bad for a couple of days and then moved on, c’est la vie.Now, let’s say i would have bought in the chrematocoulrophony (financial jesters) and sold the same option on that day. Current value is 1.20 with 2 months time value left. That is -500%. This thing would have drilled a hole in my portfolio through the center of the earth and pop out somewhere in Antarctica. It would have drilled a hole in my brain. I would feel trapped without a way out.Bottom line: system development starts with the exit in mind.Corollary: Peace of mind

Before: no clear exit strategy. I used to read every single news, check prices 2-3-5-10 times a day. I was always torn between running positions a bit longer (greed) and taking money off the table (fear).After: exit strategy for every contingency: It brought immense peace of mind. There were three booby traps: stop loss, profit target and on the time axis trend reversal. I knew that unless an exit condition was tripped, positions would run their course. I had harnessed volatility. I checked price once a day, the rest of the time, I was one of the heaviest users of YouTube on earth. This lead to surreal conversations with my boss:– “What ! Are You watching another Shaolin flick ?”, he laughed– “Why ? You are not ?”, I replied vaguely outraged by his lack of cultural curiosity “Time for some off-site (code word for plundering the Roppongi Enoteca wine shop) ?”– “it’s only 4:00 pm”, he said looking for a feeble excuse– “Yeah, I know late start, let’s get into position for the happy hour”, with high conviction for the daySystematic execution and pregnancy

Developing a system that works is the hard part. And then executing it day in day out is the hard part. This is where a lot of guys trip in the carpet. They spend considerable time developing a strategy that they run until it stops working. Then, it is back to the drawing board, tweaking endlessly, waterboarding it until it confesses. Two reasons:

- Complexity is a form of laziness: I have seen a lot of systematic strategies. The most fragile ones are always the most complex ones. Optimisation is the poor brain solution

- Faith: We trade our beliefs. The best example is Markowitz, the father of the half century old modern portfolio theory (MPT). At the end of his career, a journalist asked him the composition of his portfolio. The inventor of the efficient frontier candidly replied: 50% stocks, 50% bonds. I rest my case

Bottom line: systematic trading is like pregnancy. Either You are pregnant, either You are not. Sorry, but You can’t be un-pregnant on ladies night.Trading is 90% mental, the other half is good math

Mindfulness:

Ray Dalio meditates, twice a day. I rest my case. I meditate every day, sometimes twice during rough markets. Before trading, I seat in silence 2 to 5 minutes until presence.Check Rande Howell at Trader State of Mind. His work is unique and transformative. He works on the Pearson Marr or Jungian archetypes. I cannot recommend his work highly enough.I would highly recommend the App called Calm.com. It is reasonably priced and has excellent guided meditation.Journal your journey:

Journal your journey through the markets. Journal your emotions, when You are making money and when You aren’t. Pay particular attention to your fears when losing money.I am working on a format that could be useful and meaningful using Google sheets and Evernote. There are some elements of Nathaniel Branden’s stem sentence completion exercise. Mr Branden is famous for his work on self-esteem and deep belief elicitation. There are also elements of Byron Katie’s work. Finally, it is brought together in a quantitative format using Google Sheets.Trade with fear

Some charlatans recommend to trade without fear. That is not how the brain works, at all. Tell the antelope that a lion is just a confused cat. Fear is a signal. Fear is an evolutionary mechanism that has kept You alive to this day. Ignore it, it grows and soon enough it infiltrates your trading, it cripples your action.Fear exists in the shadow. Name it, face it, and then physically walk through it. This is why it important to journal your experience.Fear is vastly underrated. It keeps You sharp. Size your positions as though You expected them to fail.Visualisation

Athletes train to visualize their performance. There are clinical studies that show that athletes who visualize their performance have more muscle mass than those who don’t. Surprisingly enough, those who simply visualise without physical effort have higher muscle density than those who neither train nor visualise.

Visualisation does not mean seeing oneself on the podium with a gold medal, laughing under the cameras. That is wishful thinking. Visualisation is rehearsing procedures to overcome obstacles, feeling fear arousal and bringing calm response. It is about setting anchors that will trigger neuro-physiological responses.

At elite level, athletes are in similar physical shape. The difference that makes the difference is mental preparation. Best example is Conor Mc Gregor versus Chad Mendes. He won the fight mentally before he won it physically. He was on the ground, pummeled by some severe elbows to the head. Meanwhile, he was laughing: “is that all You got ?”

THE POWER OF CHECKLISTS

Airplane pilots have checklists. Firefighters have checklists. Surgeons have checklists (read Atul Gawande’s “Checklist manifesto”). Bottom line: these are highly skilled, highly trained professionals who have responsibility for human lives. They swear by checklists.Meanwhile, finance people believe it is beneath them. Investing is supposedly an art. Checklists free up some precious bandwidth that can be used for thinking. In this ultra competitive sport called trading, every extra bit of mental bandwidth spared is a competitive advantage over emotional traders.Great investors are not smarter, they have smarter habits. Break all your tasks in small specific checklists.Example: my short sell checklist

- Check risk per trade and lots: if position small (i-e too volatile), then reject

- Check exposures & balances: if trade exceed risk, then reject

- Check borrow cost and availability: if expensive, then reject

- Set Stop Loss on platform GTC

- Sell Shares at Limit validity 1 day

- Take break, do something else: cool down and refresh (2-5 mn)

- Verify one last time and send

My entire workflow is broken down into small checklists: Buy to Cover, Buy Long, Sell Long, trade reconciliations, trading signals, portfolio management system update, etc. This helps a lot during stressful times.Conclusion

When we are on the bus in a new city, we check every stop, every building. We are afraid of missing our stop. Before getting on the bus, our stress hormones are mildly activated. Once in, stress hormones go up. Bottom line, exit matters. Think about them before entry

Success is habit. Unfortunately, so is failure. They have the best habits.

Trading is mental: profits are a side effect of inner alignment between deep seated beliefs all the way to daily routines.

Great post!

Thank You very much

What subjects would You like to read about ?

Been reading your posts since i came across you on the bettersystemtrader interview, this one is very good thank you . I have just started watching some youtube clips from Rande Howell, would be great if you could give more insight into the google sheets system for journaling and meditation, anything along those lines..

Hello Jim,

http://bettersystemtrader.com/ask-laurent-bernut/

Andrew wants a re-match. It would be better if You asked on Andrew’s website. This way, everyone could benefit.

Quick answer:

According to Daniel Goleman, Self deception is a built-in feature like eyes, nose, lovely legs. This is even higher than reproduction in the pecking order. Example: when was the last time You had sex ? When was the last time You rationalised something or cooked up an excuse ?

The problem with self-deception is that it covers its tracks. Intelligent people are better at fooling themselves. So, the only way to change durably is accountability.

Journal has a prediction Versus reality check. This forces us to see we BS ourselves all the time.

Part two: once we face our human frailty, then we can take steps to change.

Journal is still work in progress, hence not on the website.

I cannot recommend Rande’s work highly enough. Tell him I sent You. Rande and Delores are amazing people

Journal is work in progress.