Algorithmic trading: How to get started building an algorithmic trading system?

This is an answer to a question on Quora: Algorithmic trading: How to get started building an algorithmic trading system?

Answer by Laurent Bernut:

If investment is a process, then the logical conclusion is automation.

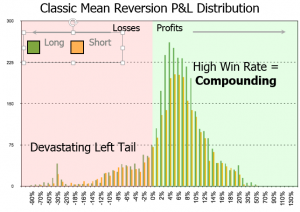

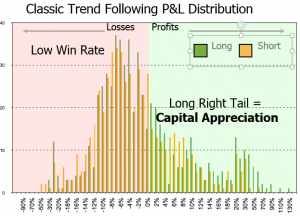

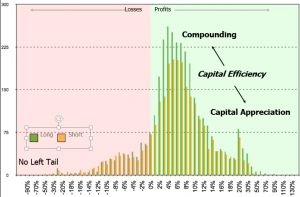

Algorithms are nothing else than the extreme formalisation of an underlying philosophy.This is the visual expression of a trading edge

Trading edge = Win% *Avg Win% – Loss% *Avg Loss%

It changed my life and the way I approach the markets. Visualise your distribution, always. It will help You clarify your concepts, shed light on your logical flaws, but first let’s start with philosophy and belief elicitation1. Why is it important to clarify your beliefs ?

We trade our beliefs. More importantly, we trade our subconscious beliefs. “If You don’t know who you are, markets are an expensive place to find out”, Adam Smith

Many people do not take the time to elicit their beliefs and operate on borrowed beliefs. Unanswered questions and faulty logic is the reason why some systematic traders tweak their system around each drawdown. i used to be like that for many years.

Belief elicitation exercises:

- The Work by Byron Katie. After i completed a 2 beliefs a day challenge for 100 days, i could explain my style to any grandmother

- 5 why ? Ask yourself a question with “why” and dive deeper

- “I am”: beliefs about self are best elicited when we start with this sentence stem

- Sentence completion exercises: Nathaniel Branden in his work on self-esteem has pioneered this method. For example, “to me a robust trading is…”

Mindsets: expansive and subtractive or masala smoothie Vs band-aid

There are two types of mindset, and we need both at different times:

- Expansive to explore concepts, ideas, tricks etc. Expansive mindset is useful in the early stage of strategy design

- Subtractive: to simplify and clarify concepts. Complexity is a form of laziness. Instead of adding yet another redundant factor, try subtracting one or two. Work hard until You find an elegant and simple solution

Systematic traders who fail at being subtractive have a smoothie approach. They throw all kinds of stuff into the optimization blender and waterboard data until it confesses. Bad move: complexity is a form of laziness.

Overly subtractive systematic traders have a band aid mentality. They hard-code everything and then good luck patching

“Essentialist traders” understand that it is a dance between periods of exploration and times of hard core simplification. Simple is not easy

It has taken me 3,873 hours, and i accept it may take a lifetime2. Exit: start with the end in mind Counter-intuitive truth

The only time when you know if a trade was profitable is after exit, right ?

So, focus on the exit logic first.

In my opinion, the main reason why people fail to automate their strategy is that they focus too much on entry and not enough on exit.

The quality of your exits shapes your P&L distribution, see chart above

Spend enormous time on stop loss as it affects 4 components of your trading system: Win%, Loss%, Avg Loss%, trading frequency

The quality of your system will be determined by the quality of your stop loss,3. Money is made in the money management module

Equal weight is a form of laziness. The size of your bets will determine the shape of your returns. Understand when your strategy does not work and reduce size. Conversely, increase size when it works.

I will write more about position sizing on my website, but there are many resources across the internet3. Last and very least, Entry

After you have watched a full season of “desperate housewives” or “breaking bad”, had some chocolate, walked the dog, fed the fish, called your mom, then it’s time to think about entry.

Read the above formula, stock picking is not a primary component. One may argue that proper stock picking may increase win%. Maybe, but it is worthless if there is neither proper exit policy, nor money management.

In probabilistic terms, after you have fixed exit, entry becomes a sliding scale probability4. What to focus on when testing

There is no magical moving average, indicator value. When testing your system, focus on three things:

- False positives: they erode performance. Find simple (elegant) ways to reduce them, work on the logic

- periods when the strategy does not work: no strategy works all the time. Be prepared for that and prepare contingency plans in advance. Tweaking the system during a drawdown is like learning to swim in a storm

- Buying power and money management: this is another counter-intuitive fact. Your system may generate ideas but you do not have the buying power to execute. Please, have a look at the chart above

I build all my strategies from the short side first. The best test of robustness for a strategy is the short side:

- Thin volume

- brutally volatile: this

- shorter cycle: stocks go up the elevator and go out the window

- Borrow availability:

Platforms

I started out on WealthLab developer. It has a spectacular position sizing library. This is the only platform that allows portfolio wide backtetsing and optimisation. I test all my concepts on WLD. Highly recommend. It has one drawback, it does not connect position sizer with real live trading.Amibroker is good too. It has an API that connects to Interactive brokers and a decent poisition sizer.

We program on Metatrader for Forex. Unfortunately, Metatrader has gone down the complexity rabbit hole. there is a vibrant community out there.

MatLab, the expensive weapon of choice for math graduates. No comment…

R: much better cost-performance than Matlab, simply because it is free

Tradestation

Perry Kaufman wrote some good books about TS. There is a vibrant community out there. It is easier than most other platformsFinal advice

If You want to learn to swim, You have to jump in the water. Many novices want to send their billion dollar ideas to some cheap programmers somewhere. It does not work like that. You need to learn the language, the logic.

Brace for a long journey

Algorithmic trading: How to get started building an algorithmic trading system?