Daily signals #Equity Indices 2015 – 04 – 13

Thought of the day: “None but ourselves can free our mind”, Bob Marley, prophet

- DSM Qatar Index Bearish Strength 2015-04-13

- MSETOP Mongolia Stock Index Bearish Strength 2015-04-13

- Great traders are not smarter, they have smarter trading habits

- If You are interested in short-selling, trading systems, position sizing, trading psychology, visit us at: www.alphasecurecapital.com

MSETOP Mongolia Stock Index Bearish Strength 2015-04-13

DSM Qatar Index Bearish Strength 2015-04-13

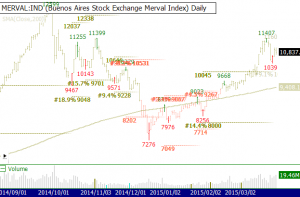

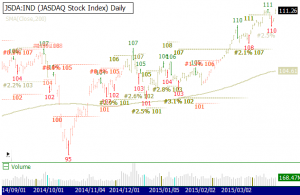

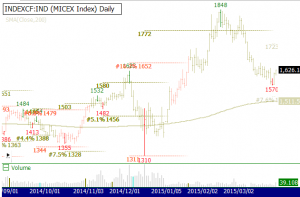

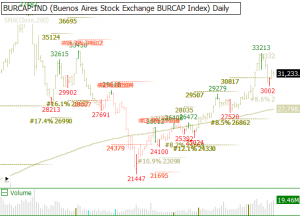

- Bullish weakness: Longer-term trend is bullish. There has been some temporary weakness, but the uptrend is likely to resume

- Bearish strength: Longer-term trend is bearish. There has been some temporary rally, but the downtrend is likely to resume

- Volatility Channels (Horizontal dotted lines) : 1 Average True Range (ATR) away from the swing

- #X%: this is the distance from the opposite Volatility Channel. For example, in a bullish trend, it would be the distance from the swing low. It can be inetrpreted as a rudimentary 1% equity at risk bet sizing

- Disclaimer: this is neither a solicitation, nor an investment advice