Summary

- If 80% of managers underperform their benchmark, we probably focus on the wrong thing. How about focusing on gain expectancy instead of stock picking ?

- Signal module: how often we win (hit ratio) is not a function of what we enter (stock picking) but how we exit.

- Money is made in the money management module: how much we win is a function of how much we bet (position sizing).

- Psychology module: Great traders are not smarter, they have smarter trading habits

The finance industry is built on the cult of the stock picker. We have been conditioned to believe that entering the right stocks is the recipe to beat the markets. Year after year, we spare no effort, expenses, technology and time just to find that golden nugget. We never stop and ask ourselves whether it works in the first place. SPIVA gives an unapologetic report on active versus index investing. Every year, about 80% of managers underperform the market by a few percentage points, the equivalent of fees plus transaction costs of one time turnover. There are probably two reasons for this.

Firstly, Charles Ellis explained in his book “winning the losers game” that markets are dominated by institutional investors. The index is therefore the average of highly educated, intelligent, hard working and ferociously competitive people. So, outperforming the index comes down to beating a very high average.

Secondly, if , year after year, we try the same old “better sameness” just a little bit harder and expect different results, only to be humbled each time, we may have been focusing on the wrong thing in the first place. The answer may lie in an equation so simple it is often overlooked: Gain Expectancy.

But first, please understand that our objective is not to throw stones at active management from our modest glass house. We are committed to helping market participants build smarter trading habits. We provide simple yet powerful tools to nudge performance: resources, research, links, Excel files.

Enter Gain expectancy

Gain expectancy is just another fancy word for average profit. All strategies without exception boil down to this formula:

Gain Expectancy = Win rate% * Avg Win% – Loss rate% * |Avg Loss%|

Using this equation, we will examine what we believe to be the four components of any strategy in increasing order of importance: entry, exit, money management and psychology.

Entry Accounts for 5% of performance

Finance is the only sport that hands out medals before the race

Finance is the only competitive sport where we expect medals to be handed out before the race. Market participants focus their energy on picking the right securities, but stock picking is the process that leads to entry. When we focus on stock picking, we just care about getting the best stocks to the starting blocks and assume they will do well thereafter. We overlook critical questions such as 1) what if they do not perform as expected, 2) how big we should be and more importantly 3) will we have the fortitude to stomach the ride ?

Stock picking is not irrelevant, it is overrated. There is no doubt that picking the right stocks increases our chance of success. The treasure hunt of stock picking is the most exciting aspect of the job. Ironically, entry is also the part that has the lowest impact on performance. Looking back at the gain expectancy formula, entry is just an ingredient of the win rate%, not the happy meal. After all, even the best ingredients will not necessarily turn into a succulent meal if there is no recipe. When everyone else is fixated on entry, paying a little more attention to other components may give us a critical edge.

In the coming articles, we will examine different types of entry techniques, common pitfalls and remedies. Everybody likes to buy on weakness and sell short on strength. But sometimes weakness is a symptom of a bigger problem and vice-versa on the short side, strength turns into bullishness.

Exit Accounts For 20% of Performance

It’s not what we pick but how we exit that determines the hir ratio

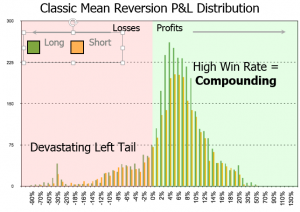

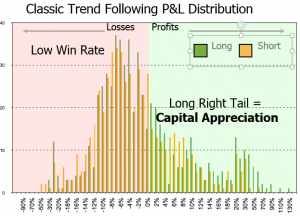

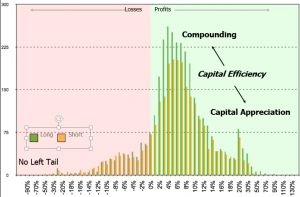

We all have been shaken out of a position and then watched it rally without participating. The hit ratio is not determined by what we enter, but how we leave. Exit is a binary event: a trade is either profitable or not. The only time when win rate% can be calculated with absolute certainty is after positions are closed. Anytime before that is just paper profit. The quality of our exits determines the shape of our P&L distribution.

Before I embraced the sophistication of simplicity, I used to believe that a certain combination of factors would generate optimal performance. I was looking for a holy grail of some sort. The first epiphany came after a Monte Carlo optimization. One of the combinations made money 19 years out of 20, despite a win rate of 34%. Meanwhile, the highest win rate (67%) lost money 17 out of 20 years. The lesson was clear: “making money in the markets is not about trying to be right. It is about accepting one is wrong and move on”. There is one class of individuals to whom it should come easy: married men.

Would You drive a car without brakes ? Then, would You trust a strategy without a stop loss ? Market participants are often refractory to the idea of a stop loss. It is however the second most important component in any strategy. It has direct impact on 3 out of 4 variables of the gain expectancy: win rate%, loss rate%, Avg loss%. In addition, it has a direct impact on trading frequency and bet sizing. Profits look big only to the extent that losses are kept small.

Entry and exit constitute the signal module. They only determine the win rate. A trading system is like a car. The signal module is the engine. The money management is the transmission and psychology is the driver.

In the coming articles, we will examine the various types of exits and their influence on the P&L distribution.

Money management accounts for 25% of performance

Same strategy, different bet sizing algorithms generate different outcomes

Money is made in the money management module. There is rampant confusion in our industry that associates alpha generation capability with high win rate. LTCM used to boast a win rate above 70%. Yet, their demise nearly took down the modern financial system. By contrast, William Eckhardt, the father of the Turtle Traders, claims a modest win rate of 35%. He has however achieved a remarkable annualized performance of 18% over a 36 year career. It is not how often we win but how much we make that ultimately determines our performance.

In a previous job, I used to run my algorithm across various portfolios. The objective was to help other managers better trade their positions 5bps at a time. Compound this over a year and this is the difference between 2nd quartile and top decile performance. The same stocks kept on reappearing in top ten bets. Managers exchange ideas and have access to the same research. There was a low dispersion of holdings, but there was a high disparity of performance. So, the difference that made the difference was obviously not stock picking: everybody owned the same stocks. The primary determinant of performance was bet sizing.

Looking back at the gain expectancy formula, bet sizing is the component that tells how much we make. It helps us achieve our investment objectives. It is also the most important component for market participants engaged in short selling activities.

In the coming articles, we will look at various position size algorithms, risk management tools so as to help You extract more alpha out of your ideas. We will look at specific techniques designed to help You clarify your objectives and achieve your goals.

Psychology Accounts For 50% of Performance

“If You don’t know who You are, this [markets] is an expensive place to find out”, Adam Smith

Great traders are not smarter, they have smarter trading habits

Unfortunately, bull markets have never boosted anybody’s IQ. We simply get overconfident during winning streaks and start gambling away. Then, during the ensuing losing streaks, we get depressed and take too little risk. In any case, we tend to abandon our discipline. Even systematic traders tend to tweak their models during losing streaks.

We have been conditioned to believe that willpower is the key to success. Unfortunately, willpower is a muscle that tires quickly, particularly under stress. For example, we all know that the key to performance is to cut losers and ride winners. So, we promise ourselves that we will reevaluate positions once stories change. Unfortunately, no plan has ever survived its collision with reality. If we leave this process to our willpower, it invariably turns into an internal debate, where our inner saboteur often convinces us to keep losers in the portfolio. Inertia creeps in and the next thing we know, our portfolio has turned into a toxic waste junkyard. The problem is: every time we say “Yes” to a loser, we say “No” to a potential winner.

Market psychology is comprised of two parts. It is the ability to execute a trading plan through winning and losing streaks alike. It is also the inner game of investing: the inner alignment from deep subconscious beliefs to daily unconscious routines. “Watch your thoughts, they become words. Watch your words, they become actions. Watch your actions, they become habits. Watch your habits, they become character. Watch your character, for it becomes your destiny”, Mohandas Gandhi

There is a simple, but not easy, solution to change our psychological make-up. According to a 2002 research paper by Wendy Wood, we spend between 45% and 60% of waking time in habitual mode. Interestingly enough, the study was conducted on young undergraduates, a segment of the population where habits are still highly malleable. Imagine how habitual our behavior can be after 10 years on the job. We probably learned for the first 2 years and then pushed the repeat button ever since.

Great traders are not smarter, they have smarter trading habits. They have developed and practiced profitable behaviors that have turned into trading rituals. The beauty of habits is that they bypass conscious decision process. They become effortless and emotionless over time. Under stress, we ditch elaborate plans and fall back to our habits. This is why installing smarter habits is critical: success is a habit and unfortunately, so is failure.

Fortunately, executing stop losses can be as emotionally intense as brushing teeth. This is a gradual process that starts, not with ruthlessly cutting losers, but with keeping a portion in the portfolio… It starts small but the compounded effects are immense. The difference between sending a golf ball off course or close to the hole is one millimeter when hitting the ball. If smarter trading habits resulted in a gain as small as 0.02% per trade, the compounded effect over 100 trades would put us in the rare company of market gurus.

At ASC, We are committed to help You build healthier trading habits. In the coming articles, we will provide You with research from the fields of finance and medical sciences, resources exercises, links that will help You change your habits.

Conclusion

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.”, Aristotle

If we want different results, then doing something different is probably a good start. Stock picking is not irrelevant, it is overrated. All it takes to nudge gain expectancy (i-e performance) is to redirect a small portion of our focus to the other components of the success formula.

Great traders are not smarter, they have smarter trading habits. We are committed to helping market participants form healthier trading habits. We will provide You with resources, links, exercises and an App on the Bloomberg portal.

Preview of the next article

- In the next article, we will introduce a powerful visual representation of gain expectancy

- Using this tool, we will reclassify strategies across all asset classes in two types

- We will provide You with suitable risk measures risk for either type of strategy

- We will introduce a new risk measure: Common Sense Ratio

- We will provide You with a simple technique that dramatically improve your win rate %